If you’re nearing retirement or already enjoying it, you’ve probably heard about Required Minimum Distributions (RMDs)—those mandatory withdrawals from your retirement accounts that kick in at age 73. They can feel like a burden, but the good news is you have some control over them. I recently came across a helpful article from The Epoch Times that breaks down how to manage RMDs, and I’m excited to share the key insights with you. Plus, I’ll explain why now is a critical time to protect your retirement savings, especially with economic uncertainties like inflation on the horizon, and how a gold IRA can help.

What Are RMDs and Why Do They Matter?

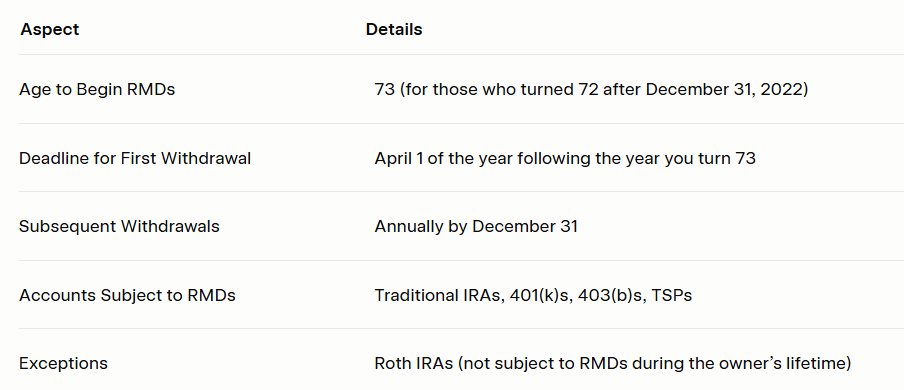

Required Minimum Distributions (RMDs) are the IRS’s way of ensuring you start withdrawing—and paying taxes on—your savings from tax-deferred accounts like traditional IRAs, 401(k)s, 403(b)s, or Thrift Savings Plans (TSPs). You must begin taking RMDs by April 1 of the year after you turn 73, with subsequent withdrawals due annually by December 31. The amount is calculated based on your account balance and life expectancy.

Why is this important?

RMDs can increase your taxable income, potentially pushing you into a higher tax bracket, reduce your account balance over time, and impact your estate planning. By managing RMDs strategically, you can minimize taxes and preserve your savings for the future.

Strategies to Manage Your RMDs

You can take control of your RMDs by focusing on three key areas: timing, amount, and source of withdrawals.

1. Timing Your RMD Withdrawals

You have some flexibility in when you take your RMDs, which can impact your taxes and financial planning:

- First RMD Deadline: Your first RMD is due by April 1 of the year after you turn 73. However, delaying it to April means you’ll need to take a second RMD by December 31 of the same year, which could lead to a larger tax bill. Many retirement savers opt to take their first RMD earlier to avoid this double withdrawal.

- Still Working?: If you’re still employed and participating in an employer-sponsored plan like a 401(k), you can delay RMDs from that plan until you retire. This doesn’t apply to IRAs, which require RMDs regardless of employment status.

- Strategic Timing: You can take your RMD anytime during the year. Some prefer early withdrawals to avoid forgetting, while others wait until year-end to align with tax planning or charitable giving strategies.

Tip: Plan your RMD timing carefully to avoid unexpected tax consequences, especially if you have multiple income sources.

2. Controlling the Amount of Your RMD

You can influence how much you need to withdraw by taking action before and after RMDs begin:

- Before Age 73: Contribute to Roth accounts, which are exempt from RMDs during your lifetime. Converting a traditional IRA to a Roth IRA in years with lower taxable income allows you to pay taxes now and reduce future RMDs. You can also withdraw more from your accounts before age 73 if you’re in a lower tax bracket to shrink the balance subject to RMDs.

- After Age 70½: Use Qualified Charitable Distributions (QCDs) to transfer up to $100,000 directly from your IRA to a charity. This satisfies your RMD without increasing your taxable income and lowers your IRA balance, reducing future RMDs.

Tip: QCDs are a fantastic way to support causes you care about while minimizing your tax burden and future RMD obligations.

3. Choosing the Source of Your RMD

If you have multiple retirement accounts, you can choose where your RMDs come from, aligning with your financial goals:

- Multiple IRAs: You can take your RMD from any combination of IRAs, as long as the total meets the required amount. For example, you might withdraw from an IRA with underperforming assets to rebalance your portfolio.

- Different Account Types: RMDs for IRAs and 401(k)s are calculated separately for each account type, so you must ensure compliance for each.

- Asset Selection: Within an account, you can choose which assets to sell—like stocks, bonds, or cash. This can be an opportunity to rebalance your portfolio, especially after a market rally.

Tip: Use RMD withdrawals strategically to optimize your portfolio, such as selling overvalued assets to maintain diversification.

Protecting Your Retirement Savings

Economic uncertainties, such as inflation, market volatility, and potential changes in tax laws, can threaten your retirement savings. Traditional accounts, often tied to stocks and bonds, are vulnerable to market swings. For instance, in 2024, the S&P 500 rose by 23.3%, boosting account balances but also increasing RMDs in 2025, which could lead to higher taxes (Kiplinger).

Diversifying your portfolio with precious metals, like gold, can provide stability. A gold IRA allows you to hold physical gold, silver, platinum, or palladium in your retirement account. Gold has historically held its value during economic downturns, making it a potential hedge against inflation and market instability.

Companies like GoldenCrest Metals specialize in helping retirement savers transfer accounts such as IRAs, 401(k)s, or TSPs into gold IRAs. They’re known for their transparent pricing, customer-focused approach, and perks like no IRA fees for the first year for qualifying accounts.

Take Action to Secure Your Retirement

Managing RMDs is just one part of protecting your retirement. By strategically handling the timing, amount, and source of your RMDs, you can minimize taxes and preserve your savings. But don’t stop there—consider diversifying with a gold IRA to add an extra layer of protection against economic uncertainties.

Before making any moves, do your research and consult a financial professional to ensure these strategies align with your goals. Your retirement plan is one of your most valuable assets, so take care of it.