I recently read a fascinating piece from Fox Business about President Trump’s 2025 tax bill, and it’s packed with changes that could impact your finances—whether you’re a parent, a service worker, or planning for retirement. As professionals, we’re always looking for ways to stay ahead financially, so let’s dive into what this bill means and how you can protect your retirement savings in these uncertain times.

Key Changes in the Tax Bill

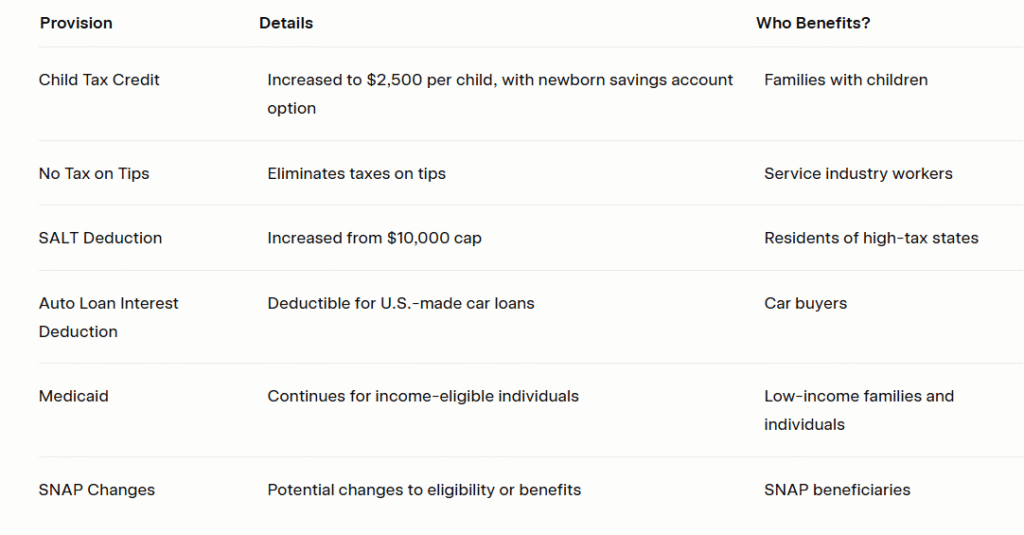

Here’s a quick look at the major provisions in the 2025 tax bill, passed by the House in May:

- Child Tax Credit Increase

The Child Tax Credit is now $2,500 per child, a significant jump that could ease the financial burden for families. There’s also an optional savings account for newborns, which is a great way to start planning for your kids’ future. - No Taxes on Tips

If you earn tips in industries like food service or hospitality, you’re exempt from paying taxes on them. This puts more money directly in the pockets of hardworking service workers. - SALT Deduction Boost

The State and Local Tax (SALT) deduction cap, previously set at $10,000, has been raised. This is a big deal for those in high-tax states, potentially lowering your tax bill significantly. - Auto Loan Interest Deduction

You can now deduct interest on auto loans for U.S.-made cars, making it a bit easier to finance that new vehicle while saving on taxes. - Medicaid Continuity

Despite concerns, Medicaid remains intact, continuing to provide free health insurance for income-eligible individuals and families. - SNAP Modifications

The bill includes changes to the Supplemental Nutrition Assistance Program (SNAP). If you rely on food stamps, stay updated on how these changes might affect your benefits.

Why Retirement Savers Should Pay Attention

While these tax changes offer immediate benefits, they also come with broader economic implications. Tax cuts can increase the federal deficit, potentially leading to higher borrowing costs or inflation. For retirement savers, this could mean greater risk to accounts like 401(k)s, IRAs, or the Thrift Savings Plan (TSP), which are often tied to volatile markets.

To protect your savings, consider diversifying with a gold IRA. This type of account lets you hold physical precious metals, which can act as a hedge against inflation and economic uncertainty.

Retirement Plans Eligible for Gold IRA Transfers

Several retirement plans can be transferred to a gold IRA, including:

- 401(k): Traditional and Roth 401(k)s can be rolled over, typically after leaving your job.

- IRA: Traditional and Roth IRAs can be converted directly.

- Thrift Savings Plan (TSP): Federal employees can transfer TSP funds upon separation or under specific conditions.

- 403(b): Common in education and nonprofit sectors, these plans are eligible for rollover.

- Pension Plans: Some pension plans allow lump-sum distributions that can be moved to a gold IRA.

Be aware of potential tax implications and fees, and consult a financial professional to ensure a smooth transfer.

Getting Started with a Gold IRA

Here’s how to set up a gold IRA:

- Select a Trusted Provider: Choose a company with strong customer reviews and experience.

- Open a Self-Directed IRA: This account type supports precious metals.

- Transfer Funds: Use a direct transfer to avoid taxes or penalties.

- Choose IRS-Approved Metals: Select gold, silver, or other metals that meet IRS standards.

Reputable companies to consider include:

- Noble Gold Investments: Offers excellent customer service and a variety of precious metals, with high ratings on Trustpilot.

- GoldenCrest Metals: Known for transparent pricing and incentives like no first-year IRA fees.

- Birch Gold Group: Trusted for over 20 years, with an A+ BBB rating and robust educational resources.

Protect Your Retirement Today

Trump’s tax bill brings opportunities like tax savings and deductions, but it also underscores the need to safeguard your retirement savings against economic shifts. A gold IRA could provide the stability you need, but it’s not a one-size-fits-all solution. Research providers like Noble Gold Investments, GoldenCrest Metals, and Birch Gold Group, and consider consulting a financial professional to make an informed decision. Stay proactive and keep your financial future secure!