How To Hedge Against Inflation – 2026 Guide for Retirement Savers

Hedge Against Inflation Strategies has become a popular topic among retirement savers seeking to diversify their portfolios and secure their future. In this article, we delve into what hedge against inflation strategies means, how it relates to your retirement goals, and why it is gaining traction in 2026. We'll explore how to hedge against inflation, what to own when the dollar collapses, safe haven assets, what is stagflation and more, offering insights from industry experts and real-life reviews from consumers. Our goal is to arm you with knowledge so you can make informed decisions with confidence and peace of mind. As always, consult with trusted gold and silver experts to tailor strategies to your unique circumstances.

Understanding Hedge Against Inflation Strategies

What Is Hedge Against Inflation Strategies?

Hedge Against Inflation Strategies refers to the concept of using hedge against inflation strategies as part of a retirement savings strategy. While traditional retirement vehicles like 401(k)s and IRAs focus on paper assets, hedge against inflation strategies incorporates physical precious metals into your retirement plan. This approach appeals to buyers who seek tangible assets that may provide stability during periods of economic volatility. For many readers of conservative media outlets and retirement planning forums, hedge against inflation strategies represents an alternative to mainstream financial products. It allows consumers to own gold or silver directly within tax-advantaged accounts and benefit from potential long-term appreciation.

Why Retirement Savers Consider Hedge Against Inflation Strategies

Retirement savers often look beyond conventional savings vehicles because they remember the economic uncertainty of past decades. The 2008 financial crisis left lasting scars, and many older Americans worry about another downturn. By diversifying with hedge against inflation strategies, buyers hope to protect themselves against inflation, currency devaluation, and market fluctuations. In 2026, concerns about political shifts, rising debt, and global instability continue to drive interest. Savvy consumers explore hedge against inflation strategies to gain a sense of security and pass on wealth to future generations. The flexibility to hold physical gold and silver through IRA-approved custodians offers a blend of tradition and modern retirement planning.

When researching hedge against inflation strategies, you'll encounter a variety of opinions and reviews. Some praise the strategy for its stability, while others highlight the need for due diligence. It's important to understand how hedge against inflation strategies works, the types of metals allowed, and storage requirements. Below, we cover key aspects that will help you decide whether hedge against inflation strategies aligns with your goals.

History and Regulatory Background

Evolution of Precious Metals in Retirement Planning

The idea of incorporating precious metals into retirement savings has evolved over decades. In the United States, the Taxpayer Relief Act of 1997 allowed certain types of physical gold, silver, platinum, and palladium to be held in self-directed retirement accounts. Prior to that, investors primarily used gold bullion or collectible coins outside tax-advantaged structures. The new legislation opened the door for retirement savers to include tangible metals as part of a diversified strategy, acknowledging their role in preserving wealth during uncertain times.

IRS Rules and Compliance

To maintain the tax-advantaged status of a hedge against inflation strategies, specific Internal Revenue Service (IRS) rules must be followed. Metals must meet purity standards—such as 99.5% purity for gold bars—and be stored with an approved custodian. Personal possession of metals purchased through a self-directed account is prohibited, and noncompliance can result in penalties and disqualification of the account. It's essential to work closely with custodians who understand these regulations and ensure that you adhere to them throughout the process. Staying compliant protects your savings and avoids costly mistakes.

Benefits of Hedge Against Inflation Strategies for Retirement Savers

Potential for Stability During Market Volatility

One of the main attractions of hedge against inflation strategies is the perception of stability. Precious metals historically have an inverse relationship with stock market performance, meaning they may retain value when equities decline. This stability can provide a cushion for your retirement portfolio, making hedge against inflation strategies a compelling option for those who lived through financial downturns. While past performance doesn't guarantee future results, owning physical metals gives you peace of mind in uncertain times.

Hedge Against Inflation and Currency Risk

Inflation erodes the purchasing power of currency over time. Many retirees worry that rising prices will reduce their nest egg's real value. Incorporating hedge against inflation strategies into your retirement strategy may help offset this risk. Gold and silver are finite resources, and their value often climbs when the U.S. dollar weakens. By holding physical metals in a self-directed plan, you're diversifying beyond paper assets and potentially protecting your wealth from currency depreciation.

Legacy and Peace of Mind

For buyers who value legacy, hedge against inflation strategies offers a tangible way to preserve wealth for heirs. Physical gold and silver can be passed down through generations, symbolizing stability and heritage. Many retirees appreciate the idea of leaving behind something of lasting value. Furthermore, having a diversified retirement strategy can reduce stress, allowing you to enjoy time with family and focus on what matters most. In our reviews of consumer experiences, many mention the comfort they feel knowing a portion of their savings is tied to tangible assets.

Step-by-Step Guide to Opening a Hedge Against Inflation Strategies

Embarking on the journey to establish a hedge against inflation strategies may seem daunting, but breaking it down into manageable steps makes the process clear and achievable. Use this roadmap to get started:

- Research and Education: Begin by learning about precious metals and self-directed accounts. Understand which metals qualify, how storage works, and the long-term implications for your retirement strategy.

- Select a Custodian: Choose an IRS-approved custodian experienced in handling metals. Look for transparent fees, secure storage, and positive customer reviews. Interview several providers before deciding.

- Open and Fund the Account: Complete the necessary paperwork to open your self-directed plan. Fund it through rollovers or direct contributions, ensuring compliance with IRS rules.

- Choose a Dealer: Partner with a reputable precious metals dealer. GoldenCrest Metals, Colonial Metals Group, Noble, Lear Capital, and Birch are popular options. Verify their credentials and service offerings.

- Purchase Metals: Work with your dealer and custodian to select and buy IRS-approved coins or bars. Consider diversification across gold, silver, platinum, and palladium.

- Arrange Storage: Your metals must be stored in an approved depository. Choose between segregated or commingled storage based on your preference and budget.

- Review and Rebalance: Monitor your holdings regularly. As market conditions change, you may need to adjust the proportion of metals within your portfolio.

Following these steps ensures that your account is set up correctly and remains compliant with regulations. Every decision you make should align with your financial goals and comfort level.

How to Set Up a Hedge Against Inflation Strategies and Choose the Right Custodian

Eligibility and Account Types

Before opening a hedge against inflation strategies, it's important to understand eligibility requirements and account types. Typically, you'll work with a self-directed retirement plan that allows alternative assets like precious metals. You'll need to choose a custodian who specializes in handling gold and silver for retirement savers. These professionals facilitate the purchase, shipping, and storage of your metals. While conventional advisors may be unfamiliar with these accounts, experts in the precious metals industry can guide you through the process.

Selecting a Precious Metals Dealer and Custodian

Choosing reputable partners is crucial. Look for dealers and custodians with strong track records, transparent fees, and positive customer reviews. Many retirement savers consider companies such as GoldenCrest Metals, Colonial Metals Group, Noble, Lear Capital, and Birch. Each offers unique services and fee structures. Compare multiple options and read independent consumer feedback. Make sure they provide secure storage, insured shipping, and full transparency.

Funding and Purchasing Metals

Once your account is set up, you can fund it through rollovers or contributions, subject to IRS rules. Work with your custodian to purchase IRS-approved metals such as gold, silver, platinum, or palladium. Ensure that the coins and bars meet purity requirements. Remember that shipping and storage fees apply, so factor these into your calculations. A well-chosen custodian will help you navigate these details and avoid common pitfalls.

Storing Your Metals and Understanding Insurance Options

Proper storage is a cornerstone of a successful hedge against inflation strategies. IRS rules stipulate that metals must be housed in an approved depository. You can choose between segregated storage, where your metals are kept separately, or commingled storage, where they share space with others' assets. Segregated storage typically costs more but offers added peace of mind. Either way, your metals remain in secure, insured facilities until you're ready to take distributions.

Insurance is another critical consideration. Approved depositories provide insurance against theft or damage, but coverage limits and terms vary. Review your custodian's policy details and ask questions about additional insurance options. Some buyers choose supplemental insurance for higher-value accounts. Knowing your metals are fully protected helps you rest easier, especially during turbulent economic times.

Comparing Hedge Against Inflation Strategies with Other Options

In addition to hedge against inflation strategies, many retirement savers explore related topics such as how to hedge against inflation; what to own when the dollar collapses; safe haven assets; what is stagflation. Let's examine how these alternatives stack up. For example, how to hedge against inflation and what to own when the dollar collapses may focus on different precious metals or account structures. While hedge against inflation strategies emphasizes physical gold and silver within tax-advantaged accounts, other strategies might include mining stocks, exchange-traded funds, or collectible coins. Each choice carries unique risks, benefits, and regulatory considerations. It's important to align your decision with your financial goals, risk tolerance, and family legacy aspirations.

Key Differences to Consider

- Ownership: With hedge against inflation strategies, you own physical metals stored in secure vaults. Other options might involve paper representations, exposing you to counterparty risk.

- Liquidity: Some alternatives allow quicker buying and selling, but they may lack the tangible appeal of holding metals.

- Fees: Custodial and storage fees apply to physical metal accounts, whereas other products have management or trading fees. Compare total costs to ensure alignment with your budget.

- Tax Treatment: Understand the tax implications of each option. Consult with qualified professionals for personalized guidance.

Ultimately, the choice between hedge against inflation strategies and other savings strategies depends on your preferences. Many retirement savers combine several approaches to balance growth and stability.

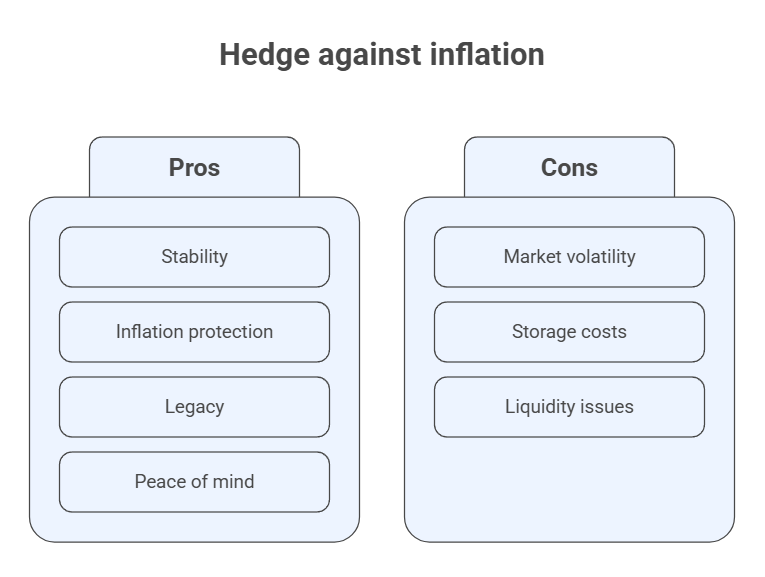

Pros and Cons of Hedge Against Inflation Strategies

No strategy is perfect, and it's important to weigh advantages against potential drawbacks. Below, we outline key pros and cons so you can make an informed choice:

- Pros: Provides diversification and potential hedge against market downturns; tangible assets for peace of mind; legacy benefits for heirs; may protect against inflation and currency risk.

- Cons: Higher fees for storage and custodial services; limited contribution amounts compared to other savings vehicles; less liquidity than paper assets; requires careful adherence to IRS rules.

- Considerations: Research dealers and custodians thoroughly; monitor market trends and adjust your strategy; talk with gold and silver experts rather than relying solely on mainstream sources.

Common Mistakes to Avoid

When establishing a hedge against inflation strategies, certain missteps can derail your progress and jeopardize your savings. Avoid these common mistakes to ensure a smooth journey:

- Neglecting Due Diligence: Failing to research custodians, dealers, and storage facilities can lead to hidden fees or poor service. Always verify credentials and read independent reviews.

- Improper Storage: Attempting to store metals at home violates IRS rules and may lead to penalties. Use approved depositories and understand storage options.

- Overconcentration: Allocating too much of your retirement savings to one asset class can increase risk. Diversify across metals and other assets to balance stability and growth.

- Ignoring Fees: Low-cost storage may come with trade-offs such as commingled storage or limited insurance. Carefully review fee structures and services.

By being mindful of these pitfalls, you can preserve your savings and maximize the benefits of hedge against inflation strategies.

Key Expert Takeaways

Experts in the precious metals industry emphasize the importance of education, due diligence, and balanced strategy. Here are some key takeaways to remember:

- Understand the basics of hedge against inflation strategies and how it fits into your broader retirement plan.

- Work with reputable custodians and dealers with positive consumer reviews.

- Consider your risk tolerance and time horizon before allocating funds.

- Stay informed about market conditions, government policies, and global events that could influence precious metal prices.

- Balance your holdings across different asset classes to avoid over-concentration.

Insights from Reddit and Quora Discussions

Online communities like Reddit and Quora are valuable platforms for gathering first-hand experiences. Users frequently share their journeys with hedge against inflation strategies, offering candid perspectives on what worked well and what they wished they'd known. For instance, some threads highlight the peace of mind gained after diversifying into precious metals, while others caution against high fees or misleading claims. Make sure to read a range of viewpoints to build a balanced understanding.

Common themes include the importance of choosing trustworthy custodians, verifying the authenticity of metals, and understanding long-term commitments. Participants often discuss their experiences with alternative companies such as GoldenCrest Metals, Colonial Metals Group, Noble, Lear Capital, and Birch. These discussions also surface tips for storing metals safely, planning rollovers, and navigating paperwork. While online forums provide real-life reviews, remember that individual experiences vary. Use them as a starting point rather than definitive advice.

Many retirement savers also express concerns about political and economic climates. Discussions often touch on inflation, central bank policies, and global conflicts. Contributors share strategies to mitigate risks and highlight how owning physical gold and silver helps them sleep better at night. Engaging with these communities empowers you to ask smarter questions when consulting with gold and silver experts.

Alternative Companies and Products to Consider

Although hedge against inflation strategies is a strong choice for many retirement savers, exploring other companies and products can broaden your perspective. Leading firms like GoldenCrest Metals, Colonial Metals Group, Noble, Lear Capital, and Birch provide various services tailored to different needs. For example, GoldenCrest Metals is known for its customer-first approach and transparent pricing, while Lear Capital offers educational resources and diverse metal options. Noble focuses on ethical sourcing, and Birch emphasizes flexibility and customer support.

Additionally, some buyers look into other savings vehicles such as silver-only accounts, platinum or palladium options, and even digital representations of metals. These alternatives may complement a traditional hedge against inflation strategies by adding variety to your portfolio. It's wise to compare features, fees, and storage solutions. Consider contacting multiple providers to gather quotes and sample contracts. Reading honest reviews can provide deeper insight into customer satisfaction and long-term service quality.

Remember that diversification is key. Mixing different metals or combining physical holdings with other retirement vehicles may enhance stability. The ultimate goal is to create a balanced, resilient strategy that meets your personal objectives.

Frequently Asked Questions

What are the basic steps to open a hedge against inflation strategies?

Opening a hedge against inflation strategies involves choosing a self-directed account, selecting a reputable custodian, funding the account via rollover or contribution, and purchasing IRS-approved metals. Work closely with gold and silver experts to ensure compliance.

Are there taxes or penalties when transferring funds to a hedge against inflation strategies?

Transferring funds from one retirement account to another can be tax-free if done correctly. Rollovers must follow specific rules to avoid penalties. Consult tax professionals for personalized guidance.

How do storage fees work in a hedge against inflation strategies?

Storage fees vary by custodian and storage facility. Typically, you'll pay annual fees based on the value or weight of your metals. Compare options to find competitive pricing.

Can I hold metals myself?

IRS regulations require metals in a self-directed retirement account to be stored with an approved custodian. Personal storage may disqualify the account and incur penalties.

Is hedge against inflation strategies right for everyone?

Not necessarily. The suitability of hedge against inflation strategies depends on your financial goals, risk tolerance, and time horizon. It's one tool among many. Balance it with other strategies for a well-rounded plan.

Conclusion

As you consider hedge against inflation strategies in 2026, remember that knowledge and preparation are essential. By understanding the basics, benefits, and potential drawbacks, you can make an informed choice that aligns with your retirement goals. Whether you explore hedge against inflation strategies alone or alongside other strategies like how to hedge against inflation; what to own when the dollar collapses; safe haven assets; what is stagflation, the key is diversification and vigilance. Read reviews, consult gold and silver experts, and take your time to compare options. Your future and family legacy deserve thoughtful planning and protection.