Investing In Gold Bars – Guide for Retirement Savers

Retirement savers are increasingly looking to diversify their portfolios with tangible assets, and the choice between gold bars and gold coins has become a central discussion. This comprehensive guide explores the nuances of “gold bars vs. gold coins,” detailing how these precious metals can fortify your retirement goals and why they are gaining significant traction in 2026.

We will delve into the specifics of investing in gold bars, compare them against gold coins, discuss popular options like Credit Suisse gold bars, cover practical aspects such as how much a gold bar weighs, and clarify the requirements for IRA-approved gold bars. Featuring insights from industry experts and real-life consumer reviews, our aim is to equip you with the knowledge to make confident, informed decisions. As always, consulting with trusted gold and silver experts is crucial for tailoring strategies to your unique circumstances.

Understanding the Appeal of Physical Gold in Retirement

The concept of integrating physical precious metals, specifically gold bars or coins, into a retirement savings strategy has grown in popularity. Unlike traditional retirement vehicles such as 401(k)s and IRAs, which primarily focus on paper assets, a self-directed Precious Metals IRA allows you to hold tangible gold. This approach appeals to investors seeking stability during economic volatility and a tangible asset for potential long-term appreciation. For many, physical gold represents a robust alternative to mainstream financial products.

Why Retirement Savers Are Choosing Physical Gold in 2026:

Retirement savers are increasingly looking beyond conventional savings vehicles due to ongoing economic uncertainties.

- Inflationary Pressures: Concerns about persistent inflation eroding purchasing power make tangible assets like gold highly attractive.

- Geopolitical Instability: Global conflicts, political shifts, and rising national debts contribute to a demand for perceived safe-haven assets.

- Desire for Tangible Wealth: Many investors value the security and direct ownership of physical assets that exist independently of any single government or financial institution.

Savvy consumers explore investing in gold bars or coins to gain a sense of security and potentially pass on wealth to future generations. The flexibility to hold physical gold and silver through IRA-approved custodians offers a blend of traditional asset protection and modern retirement planning.

The Historical and Regulatory Context of Precious Metals IRAs

The ability to include physical gold in retirement accounts is a relatively recent development, shaped by legislative changes aimed at offering greater diversification options to investors.

Evolution of Precious Metals in Retirement Planning:

The journey of incorporating precious metals into retirement savings spans decades. A significant milestone in the United States was the Taxpayer Relief Act of 1997. This crucial legislation allowed specific types of physical gold, silver, platinum, and palladium to be held within self-directed retirement accounts. Prior to this, investors typically acquired gold bullion or collectible coins outside tax-advantaged structures. This act opened the door for retirement savers to integrate tangible metals into their diversified strategies, acknowledging their role in preserving wealth during uncertain times.

IRS Rules and Compliance for Precious Metals IRAs:

To maintain the tax-advantaged status of a Precious Metals IRA, specific Internal Revenue Service (IRS) regulations must be strictly followed. These rules ensure the legitimacy and security of your investment:

- Purity Standards: All metals must meet stringent purity requirements. For gold, this typically means a minimum fineness of 99.5% (e.g., Credit Suisse gold bars, PAMP Suisse bars).

- Approved Custodian: Physical metals must be stored with an IRS-approved custodian specializing in precious metals.

- Prohibited Personal Possession: Direct personal possession of metals purchased through a self-directed account is strictly prohibited. Non-compliance can lead to severe penalties and account disqualification.

It is paramount to work with custodians who possess a deep understanding of these regulations to ensure continuous adherence, safeguard your savings, and avoid costly errors.

Gold Bars vs. Gold Coins: A Detailed Comparison for Investors

The fundamental decision for retirement savers looking to invest in physical gold within an IRA often comes down to gold bars versus gold coins. Each option presents unique characteristics that warrant careful consideration.

Gold Bars vs. Gold Coins in a Retirement IRA

| Feature | Gold Bars | Gold Coins (Bullion) |

| IRA Approval | Yes (must meet 99.5% purity) | Yes (e.g., American Gold Eagle, Canadian Maple Leaf) |

| Premium Over Spot | Generally lower (closer to market spot price) | Generally higher (includes numismatic/collectible value) |

| Sizes Available | Variety, from 1 gram to 400 oz (Good Delivery) | Typically 1 oz, 1/2 oz, 1/4 oz, 1/10 oz |

| Recognized Brands | PAMP Suisse, Credit Suisse, Valcambi, Johnson Matthey | US Mint, Royal Canadian Mint, Austrian Mint |

| Storage Space | More compact for higher weights | Can take up more space for equivalent weight |

| Liquidity | Excellent (especially standard sizes) | Excellent (globally recognized) |

| Mintage/Design | Industrial/simple design | Intricate designs, often annual changes |

Key Differences Explored:

- Premiums: Gold bars generally carry a lower premium over the fluctuating spot price of gold compared to gold coins. This is primarily because coins often have an added numismatic or collectible value, alongside their precious metal content, whereas bars are valued almost purely for their gold weight. For investors focused solely on acquiring the most gold for their money, bars can be more cost-effective.

- Sizes and Weights: Gold bars are available in a wide range of sizes, from small 1-gram bars up to the institutional 400-ounce “Good Delivery” bars. Common IRA-approved sizes for individual investors typically include 1 oz, 10 oz, and 100 oz bars. Gold coins, while also available in various denominations, are most commonly purchased in 1-ounce sizes, with smaller fractional sizes also popular for ease of transaction. For example, how much does a gold bar weigh can vary significantly, offering flexibility for different investment levels.

- IRA-Approved Options: Both gold bars and gold coins are eligible for inclusion in a Precious Metals IRA, provided they meet specific IRS purity standards. For gold bars, this means a minimum fineness of 99.5%. Popular IRA-approved gold bars include those from respected refiners like Credit Suisse, PAMP Suisse, Valcambi, and Johnson Matthey. For coins, examples include the American Gold Eagle, Canadian Gold Maple Leaf, and Austrian Gold Philharmonic.

- Recognized Brands: Brands like Credit Suisse gold bars are globally recognized for their quality and purity, making them highly liquid assets. Similarly, government-minted bullion coins from the US Mint or Royal Canadian Mint are universally accepted.

Benefits of Investing in Physical Gold for Retirement

Whether you choose gold bars or coins, holding physical gold in your retirement account offers distinct advantages in the current economic climate of 2026.

Potential for Stability During Market Volatility:

One of the primary attractions of physical gold is its historical perception as a stable asset. Precious metals often exhibit an inverse relationship with traditional stock market performance, meaning they tend to retain or increase in value when equity markets experience downturns. This inherent stability can act as a cushion for your retirement portfolio, providing peace of mind during turbulent financial times. While past performance is not indicative of future results, gold's historical role as a safe haven is well-documented.

Hedge Against Inflation and Currency Risk:

Inflation continuously erodes the purchasing power of fiat currencies over time, a significant concern for retirees on fixed incomes. Incorporating physical gold—whether through gold bars or coins—into your retirement strategy may help offset this risk. Gold and silver are finite resources, and their value often appreciates when the U.S. dollar weakens. By holding physical metals in a self-directed plan, you diversify beyond paper assets and potentially protect your wealth from currency depreciation.

Legacy and Peace of Mind:

For investors who prioritize leaving a lasting legacy, physical gold offers a tangible and enduring way to preserve wealth for heirs. Gold bars and coins can be passed down through generations, symbolizing stability and heritage. Many retirees find comfort in the idea of bequeathing an asset with intrinsic value. Furthermore, having a diversified retirement strategy that includes tangible assets can significantly reduce financial stress, allowing you to focus on family and other important aspects of life.

Navigating the Process: Setting Up Your Precious Metals IRA

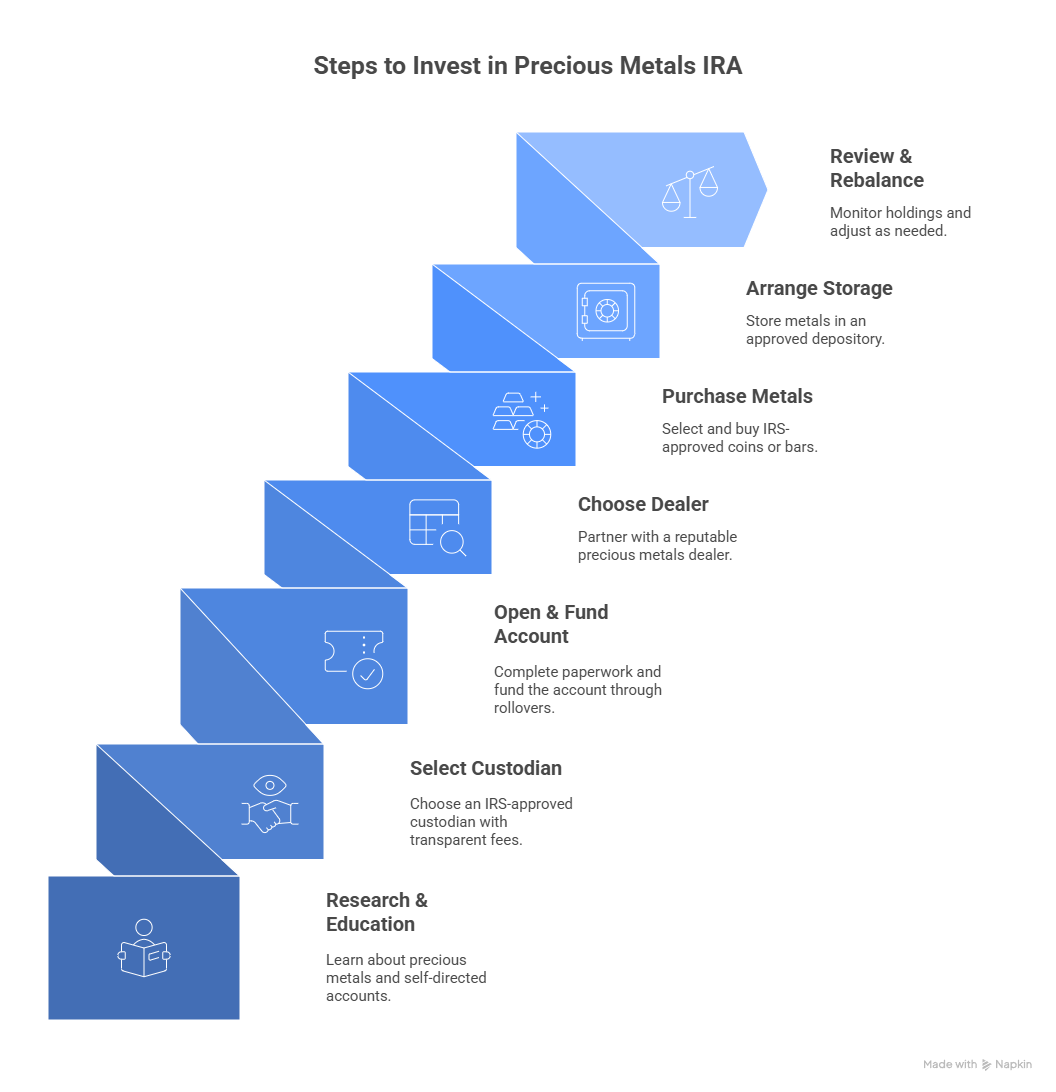

Establishing a Precious Metals IRA, whether with gold bars or coins, involves a clear step-by-step process that ensures compliance and security.

Setting Up Your Precious Metals IRA in 2026

| Step | Action | Details & Considerations |

| 1 | Research & Education | Understand the differences between gold bars vs. gold coins, IRA regulations, purity standards, and storage options. |

| 2 | Select a Self-Directed IRA Custodian | Choose an IRS-approved custodian experienced in Precious Metals IRAs. Look for transparency in fees, secure storage partnerships, and strong reviews. |

| 3 | Open & Fund Your Account | Complete necessary paperwork. Fund via direct contributions or a tax-free rollover from existing 401(k), 403(b), or Traditional/Roth IRA. |

| 4 | Choose a Reputable Precious Metals Dealer | Partner with a dealer known for integrity, transparent pricing, and excellent customer service. Verify their credentials. |

| 5 | Purchase IRA-Approved Metals | Work with your dealer and custodian to select and buy IRS-approved gold bars (e.g., Credit Suisse gold bars) or coins. Ensure purity and brand compliance. |

| 6 | Arrange Secure Storage | Your metals must be stored in an IRS-approved depository. Decide between segregated (your exact metals) or commingled storage. |

| 7 | Monitor & Rebalance | Regularly review your holdings. Adjust your precious metals allocation as market conditions change and your retirement goals evolve. |

Choosing the Right Custodian and Dealer:

Selecting reputable partners is paramount for the success and security of your Precious Metals IRA. Look for dealers and custodians with:

- Strong Track Records: Years of experience and positive client testimonials.

- Transparent Fees: Clear fee structures without hidden costs.

- Excellent Customer Service: Responsive and knowledgeable support.

- Secure Storage: Partnerships with highly secure, insured depositories.

Many retirement savers consider companies such as GoldenCrest Metals, Augusta Precious Metals, Noble Gold Investments, Lear Capital, and Birch Gold Group for their expertise in this field.

Funding and Purchasing Your Metals:

Once your SDIRA is set up, you can fund it through tax-free rollovers from existing qualified retirement plans or through direct annual contributions, always adhering to IRS limits. Your custodian will then facilitate the purchase of your chosen IRA-approved gold bars or coins from your selected dealer. Ensure that all chosen items meet IRS purity requirements (e.g., 99.5% for gold bars). Remember to factor in premiums, shipping, and storage fees into your overall investment cost.

Secure Storage and Insurance:

Proper storage is a cornerstone of a compliant and successful Precious Metals IRA. IRS rules mandate that metals must be housed in an approved, third-party depository. You'll typically choose between:

- Segregated Storage: Your specific gold bars or coins are kept separate from other clients' holdings. This offers peace of mind but usually incurs slightly higher fees.

- Commingled Storage: Your metals are stored alongside identical metals from other clients. This can be more cost-effective.

All approved depositories provide robust security measures and insurance against theft or damage. It is crucial to review your custodian's insurance policy details and coverage limits, and consider supplemental insurance for higher-value accounts.

Advantages and Considerations of a Physical Gold IRA

As with any investment strategy, a Precious Metals IRA, whether focused on gold bars or coins, comes with its own set of pros and cons.

Pros and Cons of a Physical Gold IRA

| Advantages (Pros) | Disadvantages (Cons) |

| Diversification: Reduces reliance on paper assets. | Higher Fees: Custodial, storage, and insurance costs. |

| Inflation Hedge: May protect purchasing power. | Limited Contributions: IRS annual limits apply. |

| Market Stability: Potential hedge during downturns. | Lower Liquidity: Can take longer to liquidate metals. |

| Tangible Asset: Provides security and peace of mind. | IRS Compliance: Strict adherence to rules is critical. |

| Legacy Building: A durable asset for heirs. | No Income Generation: Does not pay dividends. |

| Currency Risk Mitigation: May protect against dollar weakening. | Price Volatility: Gold prices can fluctuate. |

Common Mistakes to Avoid:

When establishing a Precious Metals IRA, certain missteps can jeopardize your investment:

- Neglecting Due Diligence: Failing to thoroughly research custodians, dealers, and storage facilities can lead to hidden fees, poor service, or non-compliant assets.

- Improper Storage: Attempting to store metals at home is an IRS violation that can result in account disqualification and penalties.

- Over-Concentration: Allocating an excessive portion of your retirement savings to a single asset class increases risk. Diversify across metals and other asset classes.

- Ignoring Fees: Be fully aware of all costs, including purchase premiums, shipping, storage, and annual administrative fees.

By being diligent and mindful of these potential pitfalls, you can preserve your savings and maximize the long-term benefits of your Precious Metals IRA.

Expert Opinions and Community Insights

A comprehensive understanding of investing in gold bars and coins benefits from both professional analysis and real-world experiences shared by investors.

Key Expert Takeaways:

Experts in the precious metals industry consistently emphasize several critical points for those considering a Precious Metals IRA:

- Educate Yourself: Thoroughly understand the market, regulations, and the unique characteristics of gold bars vs. gold coins.

- Reputation is Key: Partner with highly reputable, transparent custodians and dealers with verified positive customer reviews.

- Strategic Allocation: View precious metals as a component of a diversified portfolio, rather than a standalone investment.

- Stay Informed: Monitor global economic conditions, central bank policies, and geopolitical events that influence precious metal prices.

Insights from Online Forums (Reddit, Quora, etc.):

Online communities offer a candid perspective on the practicalities and challenges of Precious Metals IRAs. Users frequently share their experiences, discussing the peace of mind gained from diversification or cautioning against specific pitfalls. Common themes include:

- The importance of thoroughly vetting custodians and dealers.

- Discussions around the pros and cons of segregated versus commingled storage.

- Tips for understanding and navigating rollover processes.

- Concerns about inflation and how physical gold helps mitigate these risks.

While online forums provide valuable anecdotal evidence, remember that individual experiences vary, and this information should complement, not replace, advice from qualified professionals.

Exploring Alternative Companies and Related Products

While a Precious Metals IRA focusing on gold bars or coins is a robust choice for many, exploring other companies and related products can further broaden your retirement portfolio.

Leading Precious Metals IRA Firms:

Companies like GoldenCrest Metals, Augusta Precious Metals, Noble Gold Investments, Lear Capital, and Birch Gold Group are prominent in the Precious Metals IRA market. Each offers tailored services:

- GoldenCrest Metals: Known for transparent pricing and client-centric service.

- Augusta Precious Metals: Offers extensive educational resources and personalized guidance.

- Noble Gold Investments: Emphasizes ethical sourcing and client security.

- Lear Capital: Provides diverse metal options and market insights.

- Birch Gold Group: Valued for strong customer support and flexible investment choices.

It is always wise to contact multiple providers to compare their offerings, fee structures, and customer service quality.

Other Precious Metal Investment Avenues:

Beyond physical gold, consider other options to complement your strategy:

- Silver-Only IRAs: Focusing on silver, which often has both industrial and investment demand.

- Platinum or Palladium IRAs: These industrial precious metals can offer different risk/reward profiles.

- Precious Metal ETFs (Exchange-Traded Funds): These funds track the price of metals, offering liquidity but without direct physical ownership.

- Mining Stocks: Investing in companies involved in extracting precious metals, which carries company-specific risks alongside metal price exposure.

Remember, diversification is crucial. Combining various metals or blending physical holdings with other retirement vehicles can enhance your overall portfolio's resilience and potential for growth.

Frequently Asked Questions (FAQ)

What is the main difference between gold bars and gold coins for IRA investment?

The primary difference lies in their premiums and form. Gold bars generally have lower premiums over the spot price because they are valued almost purely for their metal content. Gold coins, especially government-minted bullion coins like the American Gold Eagle, often carry a slightly higher premium due to their intricate design, collectibility, and smaller denominations. Both must meet IRS purity standards for IRA inclusion.

Are Credit Suisse gold bars IRA-approved?

Yes, Credit Suisse gold bars are generally IRA-approved, provided they meet the IRS minimum purity standard of 99.5% fineness. They are a widely recognized and reputable brand in the precious metals market.

How much does a standard gold bar weigh, and what sizes are available for IRAs?

The weight of a “standard” gold bar can vary significantly. Large institutional “Good Delivery” bars weigh 400 troy ounces. However, for individual IRA investors, common IRA-approved sizes include 1 oz, 10 oz, and 100 oz gold bars. Fractional sizes like 1-gram gold bars are also available but less common for IRA investments.

What are the purity requirements for gold to be held in an IRA?

For gold to be eligible for inclusion in a Precious Metals IRA, it must meet a minimum fineness of 99.5% purity. This applies to both gold bars and coins, with some exceptions for specific government-minted coins like the 91.67% pure American Gold Eagle, which is explicitly allowed by law.

How do I transfer funds from an existing 401(k) or IRA into a Precious Metals IRA?

You can fund a Precious Metals IRA through a tax-free rollover. This typically involves instructing your current retirement plan administrator to transfer funds directly to your new self-directed IRA custodian. A “direct rollover” avoids tax penalties, whereas an “indirect rollover” (where funds are distributed to you first) has stricter time limits and potential tax implications if not completed within 60 days.

What kind of fees should I expect with a Precious Metals IRA?

You should expect several types of fees:

* Custodial Fees: Annual fees charged by your IRA custodian for account administration.

* Storage Fees: Annual fees for securely storing your physical metals at an approved depository. These can vary based on segregated vs. commingled storage and the value/weight of your holdings.

* Dealer Fees/Premiums: The difference between the spot price of gold and what you pay for the bars or coins (the premium).

* Transaction Fees: Fees associated with buying or selling your metals.

Always request a full breakdown of all fees from your chosen custodian and dealer.