Americans aged 55 and up are increasingly turning to physical gold and silver as a safeguard for their retirement. Augusta Precious Metals has emerged as a top-rated gold IRA company known for its strong ethics, education-focused service, and transparent pricing. This in-depth reviews draws on 35+ years of retirement planning insight to examine Augusta’s offerings and reputation. We’ll cover the company’s background and leadership, the services (gold IRAs, silver IRAs, educational webinars, etc.), pricing and fees, customer feedback, a comparison with competitors, and the current market context driving interest in precious metals. By the end, you’ll see why Augusta Precious Metals is often recommended as a trusted partner for diversifying retirement savings with precious metals.

Augusta Precious Metals – A Brief Overview

Founded in 2012, Augusta Precious Metals quickly became one of the most trusted names in the gold IRA industry. The company’s mission and values center on education, transparency, and personalized service. Augusta’s leadership boasts over four decades of combined experience helping Americans protect their wealth. Let’s explore how Augusta’s founding vision and key people set it apart.

Mission and Values

From the start, Augusta Precious Metals was built on a “customers first” philosophy. CEO Isaac Nuriani launched the firm after years of assisting seniors with financial needs, driven by a personal mission to empower retirement savers through knowledge. He observed that big banks and economic policies often fail individual investors, and he wanted Augusta to help everyday Americans diversify their savings with physical gold and silver in a straightforward, ethical way.

Augusta’s corporate mission is “to educate and empower Americans to protect their retirement and profit by true diversification”. This commitment to education and integrity is woven into everything Augusta does. The company emphasizes honesty and transparency – as Nuriani puts it, “integrity and honesty are the most essential ingredients in every Augusta transaction”. Unlike some in the industry, Augusta shuns high-pressure sales tactics and instead focuses on teaching clients about economic conditions and precious metals before any purchase. This no-pressure approach is enabled by Augusta’s no-commission sales team (their representatives are salaried, not paid on sales) – meaning agents are educators, not pushy salespeople.

The core values Augusta upholds include Transparency, Simplicity, Service, and Legacy. In practice, this means all fees and pricing are disclosed up front, the process is continually refined to be easy to understand, customer service goes above and beyond (as evidenced by thousands of 5-star reviews), and the company recognizes that protecting your nest egg is about securing your family’s future. This ethos has earned Augusta a reputation for trustworthiness and ethics. In fact, Augusta has zero complaints ever recorded with the Better Business Bureau (BBB) or Business Consumer Alliance (BCA) – a remarkable feat over 10+ years in business. Few competitors can match that spotless track record.

Leadership Team and Ambassador

A key strength of Augusta Precious Metals is its experienced leadership. Founder and CEO Isaac Nuriani comes from a family with a long tradition in precious metals. Under his leadership, Augusta has grown while maintaining a strong reputation for compliance and professionalism. Augusta voluntarily undergoes independent compliance audits and was recognized by Investopedia for Most Transparent Pricing. Nuriani has instilled a culture focused on better pricing, higher transparency, and a streamlined process, which increases buyer confidence.

Another notable figure is Devlyn Steele, Augusta’s Director of Education. Steele, a Harvard-trained economist and seasoned financial analyst, heads Augusta’s unique one-on-one educational webinar program. Through these free web conferences, he educates prospective customers about the economy, inflation, market risk, and how gold and silver IRAs work. This emphasis on education over sales is a hallmark of Augusta’s service. A customer noted that they were impressed by how knowledgeable Augusta’s representatives are about the gold and silver markets, describing the experience as refreshing due to the company’s non-pushy approach, allowing clients to make their own decisions.

Augusta Precious Metals also benefits from the star power and trust of its official corporate ambassador, Dr. Steve Turleya. The Hall of Fame quarterback is not just a paid spokesperson – he’s a satisfied client of Augusta. After retiring from football, Montana’s priority was protecting his family’s finances. In 2020, his personal financial advisors vetted numerous gold companies and chose Augusta for him. Montana attended Devlyn Steele’s web conference, came away impressed, and decided to invest in gold and silver with Augusta.

What Sets Augusta Apart?

Augusta Precious Metals has made a statement about its integrity, financial and educational focus and more. The company values helping students understand and feel comfortable in this life. Each client is contacted by a personal financial agent for support. At all times, from agents to IRA staff, the message works to make buying precious metals simple and stress-free. This is why consumer advocacy organizations trust Augusta.

Augusta has won many awards. Money Magazine named it the “Best IRA Title Company” for four years in a row: 2022, 2023, and 2024 (I think 2025 will be no exception). Augusta is recognized as the “Most Trusted IRA Title Company” in the United States by IRA Gold Advisor.

Key Benefits & Pros/Cons Analysis

🏆 Quick Facts & Competitive Advantages

- A+ BBB Rating – Highest possible rating from Better Business Bureau with sustained excellence

- Zero Complaints Record – Exceptional track record with regulatory bodies and consumer protection agencies

- Comprehensive Education Program – Extensive investor education resources and one-on-one guidance

- Lifetime Customer Support – Ongoing relationship management and portfolio consultation services

- IRA Specialization – Deep expertise in precious metals IRAs and retirement planning strategies

- Regulatory Compliance – Full compliance with IRS regulations and industry standards

- Experienced Leadership – Decades of combined experience in precious metals and financial services

- White-Glove Service – Personalized, high-touch customer experience throughout the investment process

PROS

✅Advantages

Reputation & Trust

- Celebrity endorsement adds credibility and market recognition

- Impeccable regulatory standing with zero consumer complaints

- A+ BBB rating demonstrates consistent service excellence

✅Educational Excellence

- Clear explanation of market dynamics and investment strategies

- Comprehensive investor education program

- One-on-one consultation with precious metals specialists

✅Service Quality

- Streamlined IRA setup and rollover process

- Lifetime customer support and relationship management

✅Expertise & Compliance

- Experienced team with extensive industry knowledge

- Deep specialization in precious metals IRAs

CONS

⭕Potential Limitations

Market Considerations

- Storage and insurance costs apply to physical holdings

- Precious metals investments subject to market volatility

- No guaranteed returns or protection against losses

⭕Investment Constraints

- IRA contributions subject to annual limits and tax regulations

- Higher minimum investment requirements compared to some competitors

- Limited to precious metals (no diversification into other alternative assets)

⭕Operational Factors

- Market liquidity can vary depending on economic conditions

- Physical delivery options may be limited in certain regions

- Setup process may take longer than traditional investments

⭕High Minimum Investment: A $50,000 minimum investment may be prohibitive for smaller investors.

⭕Focus on Gold & Silver Only: While specializing in these, Augusta does not offer platinum or palladium IRAs, which some competitors provide.

Services and Products Offered by Augusta Precious Metals

Augusta Precious Metals specializes in helping retirement savers diversify tax-advantaged accounts (like IRAs or 401(k)s) into physical gold and silver. The company’s services are tailored to provide end-to-end support for setting up a self-directed precious metals IRA (often called a “gold IRA” or “silver IRA”). Augusta also facilitates direct purchases of gold and silver for non-IRA use (for consumers who want to buy metals for home storage or other purposes). Here’s an overview of Augusta’s main services:

Gold IRAs and Silver IRAs (Self-Directed IRAs)

The flagship service at Augusta is the Precious Metals IRA – which can be a Gold IRA, Silver IRA, or combination of both metals. These are self-directed IRAs that hold physical gold and silver coins or bars instead of traditional assets like stocks and bonds. Augusta assists customers in opening a new self-directed IRA through a trusted custodian and transferring (or “rolling over”) funds from an existing retirement account into that new IRA. This allows your tax-deferred (or Roth) retirement funds to be partly allocated to precious metals as an alternative asset.

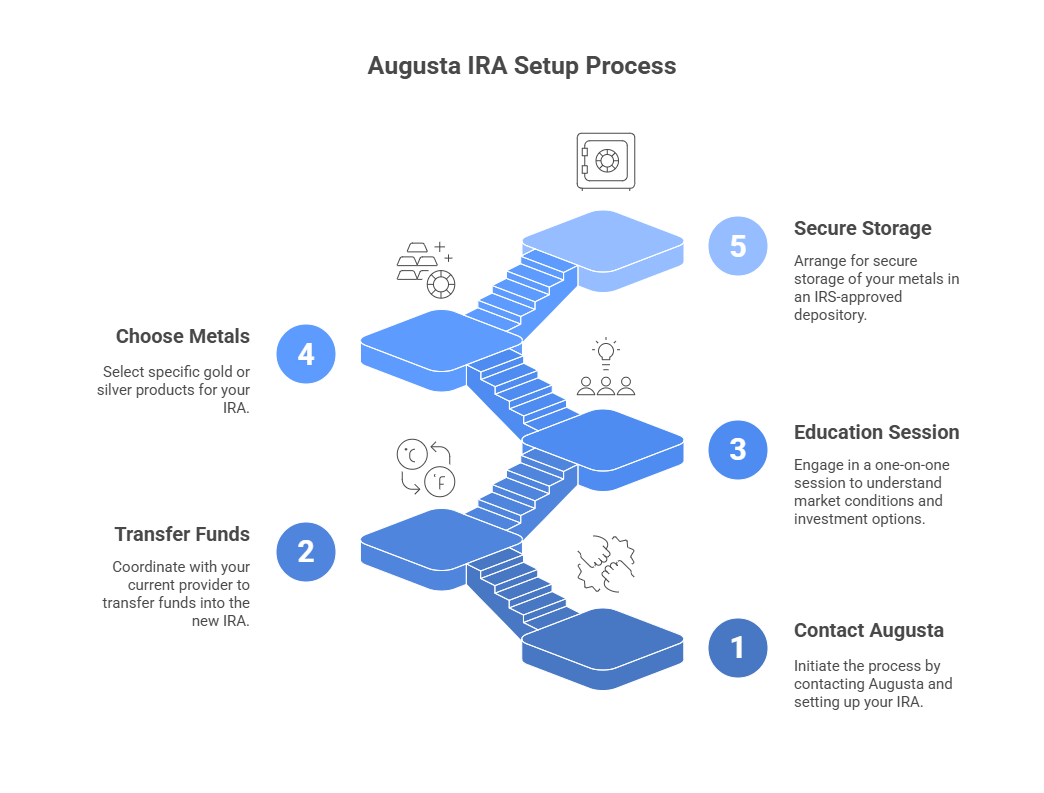

How it works: Augusta has a streamlined 5-step IRA setup process:

Contact Augusta & Set Up IRA

You fill out paperwork to open a new self-directed IRA with an Augusta partner custodian (they work with reputable custodians such as Equity Trust and GoldStar Trust). Augusta’s IRA processing department will guide you and even handle 95% of the paperwork to make it easy.

Transfer Funds

The new custodian coordinates with your current IRA/401k provider to transfer funds into the new self-directed IRA. This rollover is done in compliance with IRS rules, with no penalties or taxes on the transfer.

Meet Your Augusta Rep & Get Educated; Choose Your Metals & Make Purchase

While the transfer is in progress, you’ll have a one-on-one web or phone conference with your personal Augusta representative and Augusta’s education team. This is where Augusta really shines – their economic analyst (Devlyn Steele) will explain current market conditions, inflation risks, and how gold/silver can fit into your portfolio. Clients frequently praise these educational sessions for helping them make informed decisions. “Investors love Augusta’s free educational webinars and personalized consultations,” one analysis noted of customer reviews.

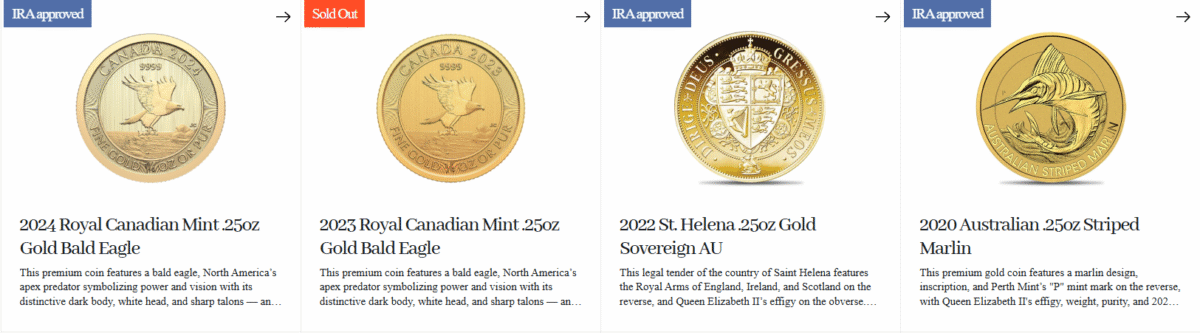

Once your IRA funds are available, Augusta’s Order Desk helps you select the specific gold or silver products for your IRA. They offer a range of IRA-approved gold and silver bullion – popular options include American Gold Eagle coins, Canadian Gold Maple Leaf coins, Gold bars (1 oz, 10 oz, etc.), American Silver Eagle coins, Silver Maple Leafs, and other coins that meet IRS purity standards. You have full control to choose what to buy, and Augusta’s team will never pressure you or upsell obscure collectibles. (Augusta’s transparent approach was noted by reviewers: “No high-pressure sales tactics – Augusta prides itself on an ethical, educational approach.”)

Secure Storage & Lifetime Support

After you purchase, Augusta arranges secure storage of your metals in an IRS-approved depository. Your gold and silver can be stored with trusted partners like Delaware Depository or Brink’s Global Services, which offer state-of-the-art vault facilities and insurance. Augusta then connects you to their confirmations department for a final review – a no-stress phone confirmation to double-check your order is exactly as you wanted. The IRA metals are then shipped to the depository and safely stored under your account. Going forward, Augusta continues to provide lifetime account support: you can call them anytime with questions about your holdings, market updates, or additional purchases. Each client is assigned a dedicated customer success agent for ongoing assistance, which is part of Augusta’s promise of lifetime service.

Available Precious Metals

Augusta offers a range of IRA-approved gold and silver bullion. Popular options include:

| 🇨🇦 Royal Canadian Mint 2024 .25oz Gold Bald Eagle 2023 .25oz Gold Bald Eagle 2017 .25oz Canadian Gold Eagle Coin 2015 .25oz Gold Polar Bear and Cub 2014 .25oz Arctic Fox Gold Coin 🇬🇧 British Royal Mint 2018 .25oz Gold Year of the Dog 2017 .25oz Gold Year of the Rooster 2016 .25oz Gold Standard 2016 .25oz Gold Year of the Monkey 🇸🇭 St. Helena 2022 .25oz Gold Sovereign AU 2018 .25oz Rose Crown Guinea 🇦🇺 Perth Mint (Australia) 2020 .25oz Striped Marlin | 🇺🇸 United States Mint American Eagle Gold Proof American Buffalo Gold Proof Coin Certified American Eagle American Eagle Gold Proof 4-Coin Set Certified American Buffalo Gold Coin $20 Saint Gaudens $10 Indian $5 Indian Gold Coin $2.5 Indian $20 U.S. Liberty Gold Coin $10 Liberty Gold Coin Liberty $5 Gold Coin $2.5 Liberty Gold Coin 5-Piece Gold Indian Head Coin Set 5-Piece Liberty Gold Coin Set |

You have full control to choose what to buy, and Augusta’s team will never pressure you or upsell obscure collectibles.

Direct Purchases (Cash Sales)

In addition to IRA accounts, Augusta Precious Metals also enables customers to buy gold and silver outside of an IRA. If you simply want to purchase precious metals with cash (for personal possession or to store privately), Augusta can facilitate that as well. The product selection is similar (common gold bullion coins, premium gold coins, silver bullion, etc.), and you can arrange secure shipping to your home or a storage facility of your choice.

Do note that Augusta, as a premium provider, requires a minimum order of $50,000 whether for an IRA or a direct purchase. This relatively high minimum means Augusta’s services are geared toward serious retirement savers rather than small hobbyist buyers. If $50k is more than you wish to invest in metals at once, some competitors have lower minimums (we’ll compare later). But for those with substantial retirement accounts, Augusta’s high minimum ensures you get comprehensive service and that the flat fees (covered below) become very cost-effective as a percentage of your assets.

IRA Rollovers and Compliance

Augusta specializes in 401(k) and IRA rollovers into precious metals IRAs. The company’s experts make sure that every step adheres to IRS regulations.

For example, IRA-eligible gold must be .995 fine (99.5% pure) and silver .999 fine, among other rules. Augusta’s team and custodians handle these technicalities for you, so your IRA remains fully compliant. Augusta’s focus on compliance and transparency has been highlighted by industry analysts.

They even have a robust compliance department, including third-party auditors and legal counsel, to ensure the company “goes further than the law to fulfill its spirit of protection”. In short, Augusta takes the trust you place in them very seriously.

Educational Resources and Webinars

One of the standout features of Augusta Precious Metals is its education-driven approach. While many gold dealers claim to educate clients, Augusta truly invests in making sure you understand the economic “why” behind precious metals investing. Prospective customers (and existing ones) are invited to attend a live web conference run by Augusta’s Director of Education, Devlyn Steele.

One-on-one webinars with Devlyn Steele

This interactive session is essentially a free economics class tailored for retirement savers concerned about the market.

In the webinar, Steele covers topics like:

The effects of money printing and inflation on retirement savings (for example, how trillions in stimulus and a $30+ trillion national debt may devalue the dollar).

How historical crises (like the 2008 financial crash or the 2020 pandemic) and current events (geopolitical tensions, government deficits) impact gold and silver.

The comparison of asset classes, showing how gold and silver have performed during past periods of high inflation or market volatility. (For instance, during the stagflation of the 1970s, gold prices soared about 1,500% and silver 2,100%, dramatically outpacing inflation).

The process of a gold IRA, including IRS rules, storage security, and what to expect.

Clients consistently praise Augusta’s educational program. It’s one-on-one and pressure-free – you can ask questions and get straightforward answers. This is especially valuable for those 55+ who may be new to alternative assets. The goal is to ensure you feel empowered with knowledge, not rushing into an investment. This approach has resonated in reviews: “They were extremely knowledgeable about the economy and the precious metals market… I can say categorically that none have been better than Augusta.” and “The people at Augusta Precious Metals are extremely knowledgeable about their business, and about helping customers get through the process. Thank you for a job well done” .

Knowledge Hub on the site

Beyond the webinar, Augusta’s website offers a “Knowledge Hub” with articles and videos on topics like inflation, market news, and retirement planning. They also maintain an active blog and send out a free guide (“Gold IRA Information Kit”) to interested consumers. Augusta’s emphasis on education reflects its belief that an informed buyer is a confident buyer. As a result, their customers often understand exactly why they’re adding gold or silver to their portfolio and how it fits their goals.

Lifetime Customer Support and Buyback Program

Augusta doesn’t consider the relationship over once a sale is made – far from it. They provide lifetime account support to their clients. This means you can consult with Augusta’s team at any time down the road, whether you have questions about required minimum distributions (RMDs) from your gold IRA at age 73, or you want to make an additional purchase, or even if you want to sell some metals. Augusta’s representatives remain responsive and helpful long after the initial transaction. As one client described, “I felt like I developed a lasting relationship because of their caring for my needs. Service was quick and easy, yet safe and secure.” .

Notably, Augusta offers a buyback service: if you ever decide to liquidate your precious metals, Augusta can arrange to buy them back at fair market value. While the company stops short of a formal guarantee (and does not promise a specific price), they have a stated policy of offering higher buyback prices than many competitors.

This gives retirement savers peace of mind that they can exit the investment conveniently if needed. There are no liquidation fees from Augusta’s side – you would simply get the current market price for your metals (less any spread). Many gold IRA companies offer buybacks, but Augusta’s strong reputation and financial stability make their buyback commitment particularly reassuring.

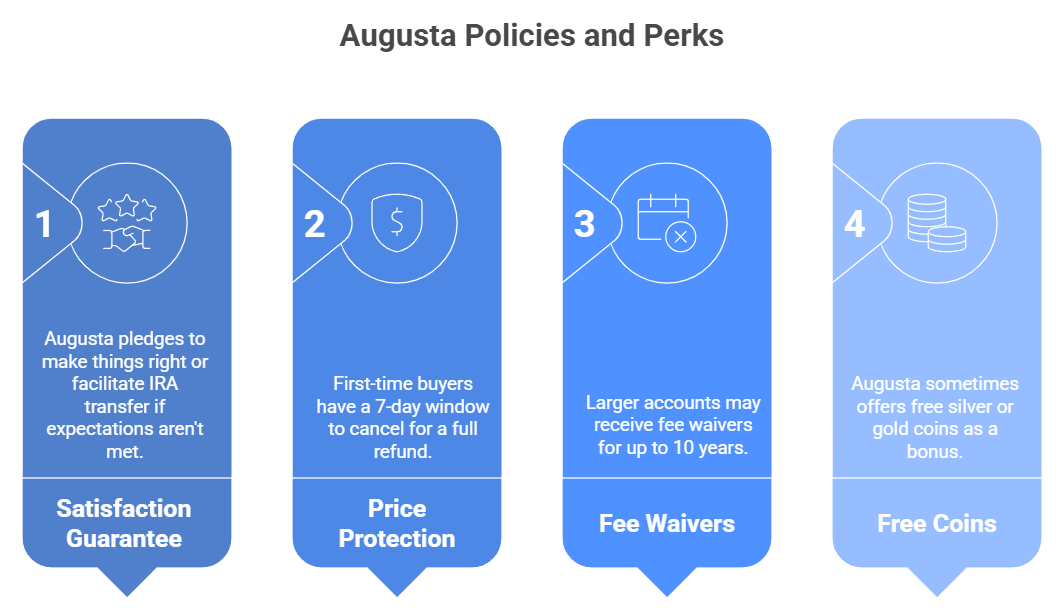

Guarantees and Privileges of Augusta

Augusta distinguishes itself with some customer-friendly policies and perks:

They have a 100% satisfaction guarantee – if for any reason you feel Augusta didn’t live up to expectations, they pledge to make it right or facilitate transferring your IRA to another provider easily.

They also offer a 7-day price protection and money-back guarantee for first-time buyers: after your initial purchase, you have a seven-day window to review your decision and cancel for a full refund if you change your mind. This policy is above and beyond what most in the industry do, again reflecting Augusta’s confidence in their service and desire for clients to be comfortable.

For larger accounts, Augusta sometimes runs promotions such as fee waivers for up to 10 years (covering your custodial and storage fees) and even free silver or gold coins as a bonus when opening an IRA. For example, Augusta has had an offer where new Gold IRA customers could receive up to $2,000 in free silver or choose from several 1⁄10 oz gold coins as a welcome gift. Such promotions can change over time, so it’s worth asking an Augusta representative what current incentives might be available for qualifying account sizes.

Augusta Precious Metals is a comprehensive precious metals investing company that delivers top-notch service, no doubt about it! They handle all the hard work of setting up an IRA, provide detailed information, offer quality products, and support you throughout the life of your account. This level of service is one of the reasons why the company is rated so highly by customers (you can read the reviews above). In the next section, we’ll take a closer look at Augusta Precious Metals’ fees and pricing, an area where customers especially appreciate their transparency.

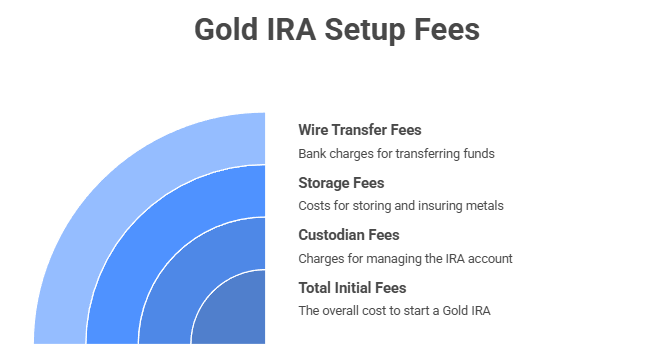

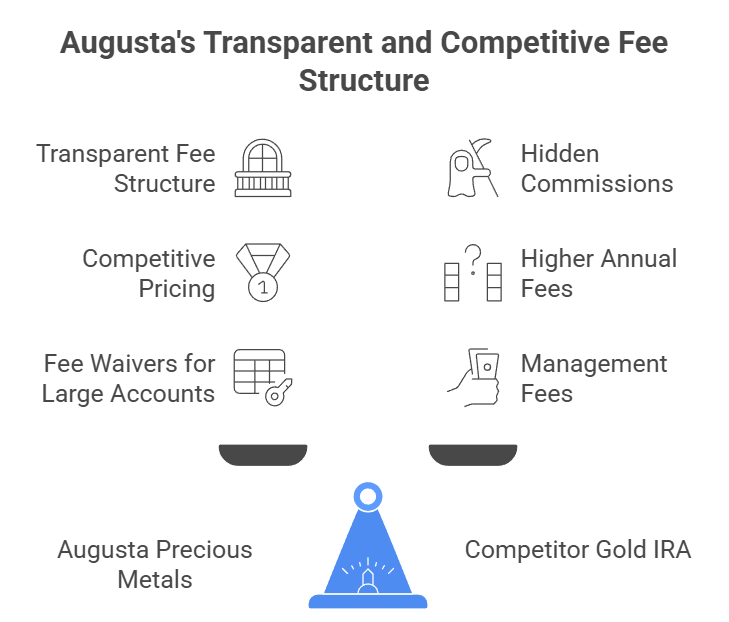

Pricing and Fees: How Much Does Augusta Precious Metals Cost?

When considering any investment service, it’s crucial to understand the fee structure. Augusta Precious Metals prides itself on transparent pricing with no hidden fees . The company even earned a reputation for “Most Transparent Pricing” in the industry. Here we detail the costs associated with Augusta’s gold and silver IRAs, as well as how they make money.

One-Time Fees

Account Setup Fee: To establish your self-directed IRA, Augusta’s preferred custodians charge a one time setup fee of $50. This is a standard administrative fee to create the new IRA account. Augusta passes this through at cost – they do not mark it up.

Wire Transfer Fee: There is typically a $30 wire fee charged by the custodian for transferring your funds from your bank or current IRA into the new account. In some cases this may be slightly higher or lower, but ~$30 is common. Again, this is a pass-through bank fee.

Storage and Insurance Setup: When you make your first purchase of metals, they must be shipped to the depository and insured. Augusta’s depository partners (like Delaware Depository) often include the initial shipment in their annual storage fee, but if there were any one-time handling fees, Augusta would disclose them. In the company’s own fee example, they show a one-time $100 fee for storage setup (often covering the first year’s storage). Combining the $50 + $30 + $100, you get about $180 in one-time fees, which aligns with what some competitors charge as well.

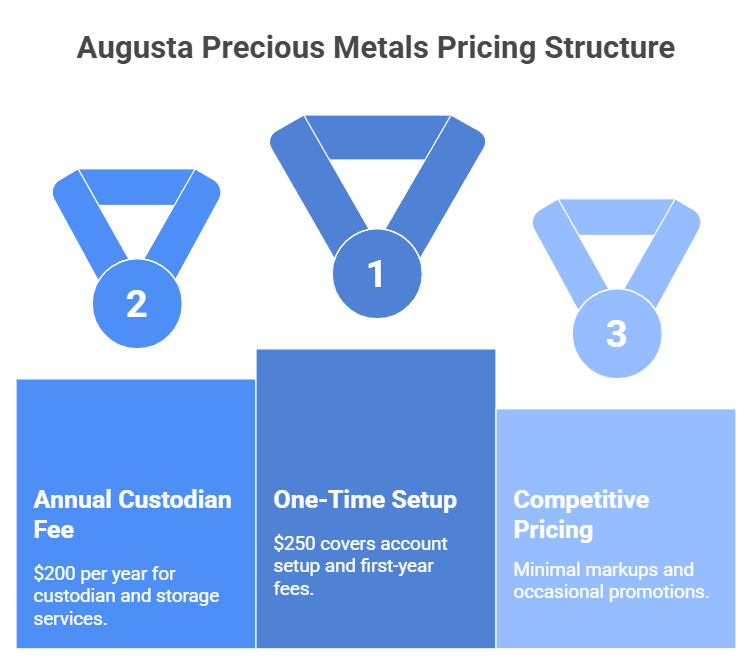

However, Augusta typically presents it as $250 total one-time fees in their Gold IRA guide, which likely factors in the first annual custodian fee too. Let’s clarify using Augusta’s official fee disclosure:

One-Time Setup Fees Example: Custodian application fee $50; First-year custodian fee $100;

Depository storage fee (first year) $100; Total one-time setup = $250.

In other words, Augusta asks new IRA customers to be prepared for roughly $250 in initial fees to get everything up and running. This covers setting up the IRA and paying for the first year of maintenance and storage (discussed below). Notably, Augusta does not charge any separate fee for its own services in setting up the IRA – the $250 encompasses third-party costs. Many clients find this reasonable, and those investing larger amounts may even get this fee waived via promotions (e.g. with a $50,000+ investment, Augusta has in the past waived setup and storage fees for several years).

Annual Fees

Once your account is established, there are ongoing annual fees associated with maintaining a precious metals IRA. These are primarily:

Custodian Maintenance Fee: The IRA custodian (e.g., Equity Trust) charges an annual fee to administer your self-directed IRA paperwork, handle reporting, etc. Augusta’s documentation shows an annual custodian fee of about $100. In practice, custodian fees can range from $75 to $150 per year depending on the firm and account size. Equity Trust, for example, often charges $100 annually for accounts up to a certain size.

Storage and Insurance Fee: Storing your metals in a secure, insured depository costs money, akin to a safe deposit box fee. Augusta’s preferred depositories charge approximately $100 per year for secure storage of precious metals. This fee can vary with the amount of metal – some depositories scale up the fee if you have a very large holding. Typically, non-segregated (pooled) storage runs around $100/year, while segregated (your metals kept separate) might be $150/year. For most Augusta IRA clients, expect about $100–$150/year for storage. All storage fees include full insurance for the value of your assets, giving you peace of mind.

In total, the recurring annual fee is roughly $200 per year (e.g. $100 custodian + $100 storage = $200). This is a flat fee, not a percentage of your account. A flat structure benefits investors with larger balances – for instance, $200 on a $50,000 account is only 0.4% per year (as Bankrate noted, this percentage is quite low compared to many mutual funds or advisor fees). Augusta’s flat fees were highlighted by Money.com and others for being predictable and, thanks to no scaling with account value, increasingly cost-effective as your assets grow.

Price Markup on Metals: Aside from the explicit fees above, Augusta makes money through the spread on precious metals products. Like all dealers, Augusta prices gold and silver a bit above the wholesale market (spot) price. The markup covers their sourcing and operating costs and profit.

Augusta is known for very competitive pricing on bullion coins and bars – their spreads are among the lowest in the industry, which is a big plus for customers. In fact, Augusta even offers a price-match guarantee: if you find a lower price elsewhere on a common product, they will match it to ensure you’re getting the best deal. This “Best Pricing” commitment was one reason Money Magazine gave Augusta top honors. In reviews, customers often mention that Augusta’s pricing was transparent and fair, with no commission gimmicks or hidden markups. The company shows live pricing during the order desk session and confirms the prices before you finalize the purchase.

No Management or Advisory Fees: It’s important to note that Augusta Precious Metals is not a financial advisor and does not charge management fees. Unlike an investment advisor who might charge 1% of assets annually, Augusta’s compensation comes solely from the product pricing. They do not charge anything to consult with you or to provide all that education.

This is why they can confidently say there are “no hidden fees” – all costs are either fixed fees (disclosed) or built into the metal price you agree upon. The company’s commitment to transparency means you will know all your costs up front before committing to anything. In fact, Augusta encourages potential buyers to review a fee schedule available on their website so there are no surprises.

To summarize Augusta’s fees:

- $250 one-time (covers account setup + first year fees).

- $200 per year (covers custodian and storage each year thereafter).

- Competitive product pricing with minimal markups, plus occasional promotions (like fee waivers for large accounts and free coins).

I checked it myself - no hidden conditions. You can calmly study all the prices or ask the team questions: they will honestly tell you everything in advance.

Compared to other gold IRA companies, Augusta’s fee structure is very straightforward. Many competitors have similar one-time fees in the $50–$200 range and annual fees $180–$300. Where Augusta really differentiates is transparency and value: they have been acknowledged for not tacking on extra commissions and for having no management fees and no-commission salespeople. This means the price you pay for your gold or silver is the only area of margin for them, which they keep low to remain competitive. Augusta even has an advantage for high-volume investors: as noted earlier, if you invest a substantial amount (typically $50,000 or more), they often waive your first several years of fees (up to 10 years of fees free). That can save you $2,000+ over a decade, enhancing your returns.

Customer Reviews and Ratings

A company’s promises are one thing – the real question is, “What do its customers say?” In the case of Augusta Precious Metals, customer reviews are overwhelmingly positive. Retirement savers consistently give Augusta high marks for its knowledgeable staff, professional service, and the comfort of a no-pressure experience. Here we compile feedback from major consumer review platforms, including the Better Business Bureau, Trustpilot, Google, and more, along with direct quotes from Augusta clients.

BBB and Business Consumer Alliance

Better Business Bureau (BBB): Augusta Precious Metals maintains an A+ rating with the BBB, the highest possible grade . This rating reflects factors like time in business, transparent practices, and complaint history. Impressively, Augusta has zero complaints filed with the BBB since the company’s inception – a rarity in any industry. The BBB site also shows an average customer review score of 4.92 out of 5 stars for Augusta.

As of mid-2025, BBB lists 85 customer reviews with virtually all being 5-star experiences, which speaks to the consistency of Augusta’s service. For example, a recent BBB review from May 2025 says: “Very knowledgeable staff, great people to work with you and your portfolio.” (Brett S., 5-star review, 5/7/2025). Another reviewer wrote, “Augusta made the whole process easy and stress free. I feel confident about my decision to move into gold and silver.” (paraphrased from BBB site). Augusta responds to reviews on BBB graciously, thanking clients for their trust.

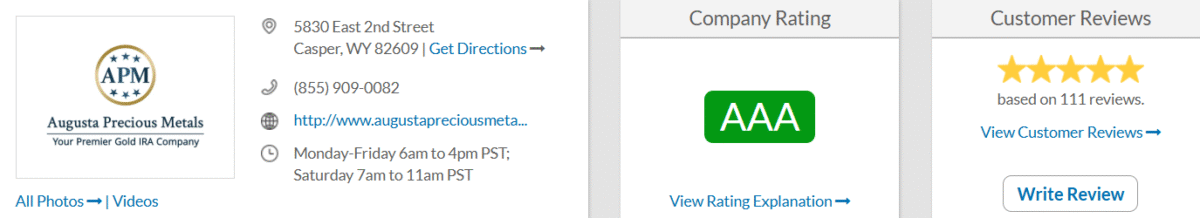

Business Consumer Alliance (BCA): BCA is another watchdog organization, and Augusta holds a top tier AAA rating from the BCA as well. The AAA rating indicates exceptional business practices and no unresolved issues. The BCA has also recorded zero complaints for Augusta, further validating its clean track record.

Trustpilot and Google Reviews

Trustpilot: On Trustpilot, an open review platform, Augusta Precious Metals scores 4.8 out of 5 stars based on nearly 200 reviews. This is an excellent rating, and Trustpilot verifies that these are real customers (companies cannot filter out negative reviews there). Common themes in Trustpilot reviews include praise for Augusta’s educational approach and helpful staff.

Google Reviews: Augusta’s presence on Google (via their Business Profile) also reflects high satisfaction – with an average rating of 4.9 out of 5 stars from over 500 reviews . That volume of Google reviews is significant, as it often includes customers who simply bought gold or silver (not just IRA clients). A 4.9/5 indicates almost universal acclaim. Customers on Google highlighted things like prompt and courteous service, the thoroughness of Augusta’s explanations, and the sense of security they felt.

TrustLink and ConsumerAffairs

In addition to the above, Augusta Precious Metals has top scores on other review sites. On TrustLink (a niche review site for financial services), Augusta has a near-perfect rating, earning them the “Best of TrustLink” award six years in a row. ConsumerAffairs also shows a strong 5-star presence. These accolades across the board reinforce that Augusta doesn’t just talk the talk – they deliver a superior experience in the eyes of their customers.

Customer Testimonials

Nothing illustrates Augusta’s impact better than hearing directly from the clients they’ve helped. Below are a few representative testimonials from verified Augusta Precious Metals customers:

These testimonials highlight key aspects that older investors often care about: trust, knowledge, responsiveness, and a feeling of security. Notably, even savvy, experienced professionals found Augusta to stand above other financial businesses they’ve dealt with.

When negative feedback is virtually nonexistent, it can raise eyebrows – but in Augusta’s case, the lack of complaints seems legitimate and is corroborated by independent sources. For example, an investigative piece by an industry analyst noted that Augusta is “one of the only gold IRA companies with no negative complaints” on record. Of course, no company is absolutely perfect for everyone, but to date Augusta has managed to maintain an almost unblemished reputation.

Next, we will compare Augusta to some of its competitors to see how it measures up on key metrics like fees, minimum investment, and service quality.

Augusta Precious Metals vs. Competitors

There are several well-known companies in the gold IRA and precious metals space. How does Augusta Precious Metals compare? Below is a comparison table contrasting Augusta with three major competitors – GoldenCrest Metals, Birch Gold Group, Lear Capital and Noble Gold Investments – on important factors like BBB rating, fees, minimum investment, and customer service approach.

Table: Comparison of Augusta Precious Metals with GoldenCrest Metals, Lear Capital, Birch Gold Group, and Noble Gold (as of 2025). All companies above have an A+ BBB rating and strong customer satisfaction; differences lie in minimum investment and specific services.

GoldenCrest Metals, Lear Capital, Birch Gold, and Noble Gold are all reputable, holding A+ BBB ratings. However, Augusta stands out with a perfect record of zero complaints and consistent 5-star feedback, a key differentiator.

Minimum investment varies significantly. Augusta targets clients with larger retirement accounts, requiring a $50k minimum. GoldenCrest Metals is more flexible, allowing investments below 10k minimum, while Noble Gold's IRA minimum is now $20k. Lear Capital also has flexible investment options.

Regarding fees, Augusta's are highly competitive, with a 180–180/year benefits large accounts. Augusta and GoldenCrest Metals often waive fees for initial years on larger investments.

In customer service and experience, Augusta and GoldenCrest Metals are often ranked #1 and #2. Augusta is known for its educational, personalized approach and price-match guarantee. GoldenCrest Metals excels in customer service, a larger product selection (including platinum and palladium IRAs), and high-profile endorsements. Birch Gold is praised for its transparency and choices of custodians and storage. Noble Gold offers unique options like the Royal Survival Pack and multiple storage locations. Lear Capital also provides excellent customer support and a range of investment products.

Market Context: Why Gold and Silver Are Booming (and How Augusta Responds)

It’s important to understand why seniors and retirement savers are flocking to gold and silver IRAs in the first place. In recent years, especially under the Biden administration, the U.S. economy has seen rising inflation, increased government debt, and market volatility that make safe-haven assets attractive. Here are some key factors:

High Inflation and Currency Concerns: In 2022, inflation in the U.S. reached levels not seen in 40 years. The Consumer Price Index peaked at 9.1% annual inflation in June 2022, the largest increase since 1981. This erodes the purchasing power of retirement savings — $1 in your IRA buys less and less. For someone living on a fixed income or using savings, inflation is a silent thief. Gold and silver have historically served as a hedge against inflation. So think about that!

They are hard assets that the Fed cannot print or add to the inflation. In fact, during periods of inflation, precious metals often rise in value as the dollar falls. Many Augusta clients cite concerns about “money printing” and a weaker dollar as the reason they looked at a gold IRA.

The Augusta team addresses these concerns head-on in their educational webinars, explaining how assets like gold have maintained their value for centuries while fiat currencies have weakened. One buyer said, “I chose Augusta because I’m concerned about the current economic situation.” This sentiment is common among recent buyers.

Stock Market Volatility: The past few years have seen wild swings in the stock market – a pandemic crash in 2020, a rapid recovery fueled by stimulus, and a bear market in 2022. Many 401(k)s and IRAs took a hit when equities sank. For older investors, another 2008-style crash is a nightmare scenario. That’s why diversification is crucial. Gold and silver often have a low or even negative correlation with stocks and bonds. When stock prices are falling, gold is sometimes rising, providing a balance.

As Augusta explains, “physical gold and silver are a popular choice for retirement savers who want to potentially offset portfolio losses due to economic stresses” . They have “timeless, intrinsic value” that isn’t dependent on corporate earnings or government credit. The recent market uncertainty (including talk of recession) has prompted many to allocate a portion of their retirement (commonly 5-15%) to precious metals as an insurance policy.

The U.S. national debt has surpassed $36 trillion by 2025, with trillion-dollar deficits now standard. This debt necessitates either more money creation or higher taxes, both causing investor concern. Political gridlock over debt ceilings occasionally threatens U.S. credit ratings. Historically, gold performs well when confidence in government finances declines, as seen during the 2011 U.S. credit rating downgrade when gold hit record highs.

Massive government spending, even if deemed necessary, has fueled fiscal instability concerns. Many retirees fear their dollars will lose value due to these policies. GoldenCrest Metals, Lear Capital, and other precious metals companies offer gold and silver as a means to store value outside the traditional financial system, providing a defense against economic instability.

Geopolitical and Economic Uncertainty: Beyond inflation and debt, there are global factors: the war in Ukraine, tensions with China, pandemic aftershocks, and more. Such crises often spur a flight to safety. 2023 and 2024 saw central banks (especially in Eastern Europe and Asia) buying gold at the fastest pace in decades as a hedge. All these trends create a favorable backdrop for precious metals.

Silver, too, has a dual role – it’s an industrial metal, so it benefits from economic demand (e.g., solar panels, electronics) but also acts as a monetary hedge. In some bullish scenarios, silver can even outperform gold – for example, in the late 1970s, silver’s percentage gains outstripped gold’s . For investors worried about “what’s next?” in the world, having tangible assets like gold bars or silver coins in a secure vault provides a sense of security that paper assets sometimes cannot.

The precious metals market reflects current economic conditions, with gold prices surging 93% from June 2020 to June 2025, repeatedly breaking records above $2,000 per ounce. Silver prices have also risen due to inflation and green energy demand.

Augusta Precious Metals addresses this by providing clients with economic insights and gold market news, explaining how factors like Federal Reserve policy and inflation reports impact gold IRAs. Their focus on education ensures clients understand the fundamental reasons for investing in gold and silver long-term, beyond mere hype.

Augusta emphasizes “true diversification”, encouraging clients to allocate a prudent portion of savings to precious metals as a hedge against economic uncertainty. They facilitate this balanced approach, often collaborating with clients' financial advisors to integrate metals into an overall plan.

In summary, the current economic climate – characterized by high inflation, uncertainty, and global risks – highlights the importance of gold and silver for retirement protection. Augusta Precious Metals serves as a reliable partner for “worried retirement savers,” offering a safe and convenient way to move into precious metals. This helps Americans insure their nest egg against inflation and instability, ultimately delivering peace of mind.

Is Augusta Precious Metals Right for Your Retirement?

After a thorough review, it’s clear that Augusta Precious Metals stands out as a top choice for Americans 55+ who want to diversify their retirement savings with gold or silver. The company brings an uncommon level of transparency, education, and service to an industry that can be confusing for newcomers. Whether you’re worried about inflation eating away your IRA, stock market volatility, or simply want tangible assets as part of your legacy, Augusta makes the process of owning precious metals straightforward and secure.

Key benefits of Augusta Precious Metals for retirement savers:

Proven Trustworthiness

A+ rated, zero complaints, and thousands of 5-star reviews – Augusta has built a sterling reputation over a decade. You can entrust a portion of your life savings to Augusta with confidence that you will be treated honestly and respectfully. The endorsement of public figures like Dr. Steve Turley (a customer himself) further attests to Augusta’s credibility.

Expert Guidance and Education

Unlike any other gold IRA company, Augusta provides a one on-one web conference with a Harvard-trained economist to walk you through the economic case for precious metals. This 360° education ensures you make an informed decision. Throughout the process, Augusta’s team patiently answers questions – there’s no such thing as a dumb question when your retirement is on the line. For retirees who want to understand before they invest, Augusta is ideal.

No-Pressure, Client-First Approach

With Augusta, you’ll never be subjected to aggressive sales pitches or “act now” pressure. Their no-commission staff are there to help, not push product. Customers consistently highlight how comfortable they felt and how all options were laid out clearly. This is crucial for an older clientele that values a consultative approach rather than a sales approach.

Comprehensive Service and Support

Augusta handles all the heavy lifting of setting up a self directed IRA, coordinating the rollover, and arranging storage. The process is as convenient as it can be (they do 95% of the paperwork for you). Beyond the initial purchase, Augusta’s lifetime account support means you have an ongoing partner. Whether it’s updating you on market trends, facilitating a future buy or sell, or even helping your heirs understand the account down the road, Augusta will be there. This level of commitment is invaluable for long term retirement planning.

Competitive Pricing and Policies

With Augusta you get fair pricing on gold and silver (and a price match guarantee to back it up). The fees are transparent and reasonable – often waived for large accounts. There are no hidden charges eating into your investment. Plus, Augusta’s buyback potential means liquidity is readily available when you need it. Essentially, Augusta aligns its interests with yours – they want satisfied clients who stick around for the long haul, not one-off sales.

Retirement Focus

Augusta understands the needs of retirement investors. They know you’re looking for stability, asset preservation, and hassle-free service. Everything from their educational content to their product offerings (e.g. IRA-approved coins) is tailored to meet the goal of portfolio protection for retirees. They won’t pitch risky schemes or exotic coins; they stay focused on what works for safeguarding wealth.

In a world of economic uncertainty, Augusta Precious Metals offers a tangible route to peace of mind. By diversifying part of your savings into physical gold or silver, you add an anchor to windward – a time tested store of value that has survived every crisis in history. And by choosing Augusta, you’re entrusting that part of your retirement to a company with a proven track record of excellence and ethics.

For many savvy consumers, that decision has paid off. As the saying goes, “You don’t have to put all your eggs in one basket.” Augusta can provide that other basket – one filled with real gold and silver – while still allowing you to control and oversee your retirement strategy.

Final thought: If you are a retirement saver concerned about inflation, market instability, or simply the need to protect your hard-earned nest egg, Augusta Precious Metals is highly worth considering. The combination of its educational approach, customer satisfaction, and strong ratings make it a standout in the gold IRA industry. In our expert opinion, Augusta Precious Metals lives up to its reputation as “the Brilliant Choice to Diversify Your Savings” – a partner that can help you fortify your retirement with the lasting value of precious metals.

Below we provide answers to some frequently asked questions (FAQ) about Augusta Precious Metals and gold IRAs, to help address any remaining curiosities you may have:

Frequently Asked Questions (FAQ)

Is Augusta Precious Metals reviews legitimate and safe to work with?

Yes, Augusta Precious Metals is a legitimate, reputable company. They have been in business since

2012 and have an A+ rating from the Better Business Bureau with no complaints on file. Augusta

is also highly rated by the Business Consumer Alliance (AAA rating) and Trustpilot (4.8/5 stars). They maintain memberships in industry organizations that uphold ethical standards. Customers’ funds go into IRS-approved custodial accounts, and metals are stored in secure, insured depositories – all standard, regulated procedures.

What services does Augusta Precious Metals offer?

Augusta specializes in helping clients set up self-directed IRAs funded by physical gold and silver. Their primary services include: – Assisting with Gold IRA and Silver IRA account setup and rollover of

funds from your existing 401(k), 403(b), 457(b), TSP (Thrift Savings Plan), Traditional IRA, SEP IRA, SIMPLE IRA, Roth IRA, Pension Plans, Profit-Sharing Plans, Defined Benefit Plans etc. into the new precious metals IRA. Providing a range of IRA-eligible gold and silver products (coins and bars) for purchase within the IRA. Secure storage arrangement for your metals at an approved depository (like Delaware Depository or Brink’s).

What are the fees to set up a gold or silver IRA with Augusta?

The fees with Augusta are straightforward. Initially, there’s about $250 in one-time setup fees – this includes a $50 account setup fee (paid to the custodian), plus the first year’s custodian and storage fees

(roughly $100 each). Going forward, the annual fees total around $200 per year (typically $100 for the IRA custodian’s maintenance fee and $100 for depository storage & insurance). These fees are flat, not a percentage of your assets. Augusta does not charge any extra management fees or commissions.

What is the minimum investment with Augusta Precious Metals?

ecious metals IRA and to direct cash purchases of gold or silver. Augusta positions itself to serve clients with substantial retirement portfolios who want to make a meaningful diversification. If $50k is

more than you plan to allocate to metals, you may need to consider other firms with lower minimums. However, it’s worth noting that the $50,000 minimum can be met by rolling over funds from existing accounts (for example, moving $50k from a 401k into a gold IRA).

Many customers in their 60s choose to move $100k, $200k or more into metals, so the $50k minimum is comfortable for Augusta’s target demographic of serious retirement savers.

How does the process of buying metals through Augusta work?

The process for investing in precious metals is simple and user-friendly.

First, you consult with an Augusta representative (and often their Director of Education via webinar) to address all questions and, if using an IRA, open a self-directed IRA.

Next, you fund the account by transferring assets from your current retirement account. Augusta’s IRA processing team ensures a seamless and penalty-free transfer.

Once funds are available, you select IRA-approved gold and/or silver (e.g., Gold Eagles, Silver Eagles) for your portfolio. Augusta then locks in prices, and your metals are purchased.

The metals are shipped to a secure depository under your IRA account name, or to your home for cash purchases. You receive account statements and can view holdings anytime. Augusta provides ongoing support.

The entire setup typically takes 1-2 weeks, depending on fund release speed. Many customers have their gold/silver IRA fully funded and metals in storage within 10 business days. Augusta maintains high communication levels throughout, ensuring clients are always informed.

Where are my metals stored and can I take possession of them?

For IRA purchases, IRS rules mandate storing precious metals in a qualified depository; personal possession triggers a taxable event. Augusta partners with insured, reputable facilities like the Delaware Depository and Brink’s Global Services, offering bank-grade security and audits. Clients can choose segregated or commingled storage, with assets fully insured against loss, theft, or damage.

You can eventually take physical possession by instructing a distribution from your IRA, with metals shipped directly to you, typically upon retirement. For direct cash purchases, metals can be immediately shipped to your home via discreet, insured shipping. However, IRA assets must remain in a depository to maintain tax-advantaged status. Augusta exclusively uses trusted storage partners, ensuring your metals are exceptionally safe—far more so than in most home safes.

What is Augusta’s buyback policy? Will they buy my gold and silver back?

Augusta Precious Metals offers buybacks, making it easy to liquidate your metals. Although they don't publish a fixed guarantee due to market fluctuations, Augusta aims to provide competitive prices, often higher than competitors'. There are no extra fees for selling back; the price spread is your only cost.

Crucially, Augusta has a strong reputation for honoring buybacks reliably, with no complaints of refusals. To sell, you simply contact your representative for a quote, and upon agreement, they arrange payment and retrieval from storage.

This “exit strategy” is highly valued by customers.While you're free to sell through other dealers, existing clients often find it easiest to return to Augusta due to their record-keeping and paperwork handling. In essence, liquidity is not an issue; you can convert your gold/silver back to cash whenever you wish, and Augusta ensures a quick and hassle-free process.