As retirement nears, many Americans in their late 60s seek to protect their savings from economic uncertainties like inflation, market volatility, and geopolitical risks. A Gold IRA, a self-directed retirement account holding physical precious metals, offers a reliable way to diversify and secure your financial future.

Choosing the best gold IRA companies is essential for retirement savers aiming to safeguard their wealth and provide stability for their families.

This guide, tailored for those nearing retirement, addresses concerns such as lack of trust in traditional markets, fears of financial instability, and spouse objections.

Drawing on reputable sources like the Better Business Bureau (BBB) and Trustpilot, we’ve evaluated top companies to help you make informed decisions.

Consult gold and silver experts to find the right Gold IRA provider for your needs.

- Best Gold IRA Companies Comparison (2025)

- Review of the Top Gold IRA Companies

- #1 — GoldenCrest Metals

- Professional assessment

- #2 — Colonial Metals Group

- Professional Assessment

- #3 — Noble Gold Investments

- Professional Assessment

- #4 — Birch Gold Group

- Professional Assessment

- #5 — Lear Capital

- Professional Assessment

- Ranking Criteria for Top Gold IRA Companies:

- What is a Gold IRA?

- Buy Physical Precious Metals IRA

- Gold IRA Rollover

- A Brief History of Gold as an Asset

- A Gold IRA Offers The Greatest Potential Profits

- Clear Conclusions And Obvious Observations

- Get Free Investment Kits!

Best Gold IRA Companies Comparison (2025)

| Company | BCA Rating | BBB Complaint History | TrustLink Rating | IRA Policies Supported | Metals Offered | Fees | Minimum Investment |

|---|---|---|---|---|---|---|---|

|

GoldenCrest Metals Visit Website |

A | 0 complaints, fully accredited | 5.0 ★ | Traditional, Roth, SEP, SIMPLE, 401(k), 403(b), TSP, Pension | Gold, Silver, Platinum, Palladium | $50–$100 setup, $150/year admin, $100–$150 storage | $10,000 |

|

Colonial Metals Group Visit Website |

A– | No major complaints | 4.8 ★ | Traditional, Roth, SEP, SIMPLE, 401(k), 403(b), TSP | Gold & Silver | $50–$100 setup, ~$150/year admin, $100–$150 storage | $20,000 |

|

Noble Gold Visit Website |

A+ | Minimal, quickly resolved | 4.9 ★ | Traditional, Roth, SEP, SIMPLE, 401(k), 403(b), TSP | Gold, Silver, Platinum, Palladium | $80 setup, $150 admin + $100 storage (flat) | $10,000 |

|

Birch Gold Group Visit Website |

AAA | Very low, A+ BBB rating | 4.8 ★ | Traditional, Roth, SEP, SIMPLE, 401(k), 403(b), TSP | Gold, Silver, Platinum, Palladium | $50–$100 setup, ~$180–$200 total annual fees | $10,000 |

|

Lear Capital Visit Website |

A | A+ BBB rating (past FTC issue) | 4.7 ★ | Traditional, Roth, SEP, SIMPLE, 401(k), 403(b), TSP | Gold, Silver, Platinum, Palladium | $50–$100 setup, $160–$200 annual incl. storage/admin | $10,000 |

Review of the Top Gold IRA Companies

Choosing the best IRA gold company for 2025 requires applying some pretty high standards, so I’ve done my best to research the top candidates. I’ve come up with a list of credentials, so follow my analysis but check for yourself.

#1 — GoldenCrest Metals

Best for: Conservative investors who value security, education, and hands-on support!

Your Trusted Partner for Gold IRA Rollovers & Wealth Preservation!

GoldenCrest Metals has surged in popularity in 2025 thanks to its white-glove service, no-pressure approach, and exclusive focus on wealth preservation through physical metals. Based in the U.S. and run by seasoned precious metals experts, the firm stands out for its personalized rollover support and education-driven onboarding process.

Unlike many competitors, GoldenCrest Metals doesn’t outsource their IRA setup. From day one, you’ll speak with a U.S.-based specialist who walks you through every step — from initiating your transfer to selecting the right mix of IRS-approved bullion and coins.

Highlights:

📦 Free investor kit mailed to your home (includes market insights & rollover tips)

🛡️ Dedicated retirement specialists — no aggressive sales tactics

🔐 Segregated storage options available in top-tier depositories

Company Profile

| Category | Details |

|---|---|

| BCA Rating | A |

| BBB Complaint History | No major complaints reported |

| TrustLink Rating | 5.0 stars (based on verified reviews) |

| Industry Reputation | Rapidly growing with strong referrals from existing clients |

| IRA Policies | Traditional, Roth, SEP, SIMPLE, 401(k), 403(b), Thrift Savings Plan (TSP) |

| Precious Metals Offered | Gold, Silver, Platinum, Palladium (bullion + IRA-approved coins) |

| Fees | Transparent flat-rate storage + account maintenance |

| Minimum Investment | $10,000 |

Professional assessment

GoldenCrest Metals is a rare example of a new Gold IRA company that doesn’t just promise transparency—it actually delivers it. According to analysts at Morss Global Finance, GoldenCrest has “broken the mold” in an industry often dominated by aggressive sales tactics and hidden fees.

💬 Key Expert Takeaways:

- Exceptional reputation: 5/5 ratings on BBB, Trustpilot, and Google with zero complaints—nearly unheard of for a newcomer.

- Transparent pricing: All fees and terms are published openly, with no fine print or bait-and-switch tactics.

- Educational approach: Instead of pressure, clients receive consultations, guides, and step-by-step onboarding.

- Secure storage: Partnerships with Delaware Depository and Entrust Group signal serious compliance and industry standards.

- Public endorsements: Support from Joe Pags and Michael Savage adds credibility and visibility.

⚠️ Considerations:

- The company is still young (founded in 2023), and while the team is experienced, long-term resilience remains unproven.

- Some experts note that the lack of pricing on the website may make initial comparisons more difficult.

What Does GoldenCrest Metals Offer?

GoldenCrest Metals specializes in precious metals IRAs, helping Americans roll over traditional retirement accounts like 401(k), 403(b), and TSP into self-directed IRAs backed by physical gold and silver.

Whether you're nearing retirement or planning ahead, GoldenCrest provides:

- ✅ IRS-compliant Gold & Silver IRA setup

- ✅ Support for Traditional, Roth, SEP, SIMPLE IRAs

- ✅ Rollover assistance for 401(k), 403(b), 457, TSP, pension plans

- ✅ Access to IRA-approved bullion and high-purity coins

- ✅ Educational resources with economic insights and inflation hedging strategies

Unlike some competitors, GoldenCrest never pushes obscure numismatics or overpriced collectibles. Their product offerings are simple, reliable, and designed for long-term capital protection.

GoldenCrest Metals: A Transparent Leader in Gold IRAs

While many firms offer precious metals IRAs, GoldenCrest distinguishes itself through its hands-on service model and focus on long-term client success, not just transactions.

Here’s how they rise above the competition:

- No high-pressure sales – Clients consistently report calm, informed consultations.

- U.S.-based specialists – From your first call, you're paired with a real person, not a call center.

- Fast setup turnaround – Rollovers can be completed in 48–72 hours in many cases.

- Client-first philosophy – GoldenCrest thrives on referrals and repeat business, not marketing gimmicks.

- Extensive learning resources – From inflation to central bank policy, their investor education materials are top-tier.

This makes GoldenCrest especially popular among conservative retirement savers 55+ and younger high-income earners seeking to diversify away from the volatile stock market.

Client Experience & Trust Signals

GoldenCrest Metals has quickly developed a reputation for integrity and excellence, even as a newer firm in the space.

- ⭐ 5-star average across TrustLink & verified reviews

- 🏅 No major complaints reported to the BBB

- 🔁 Strong referral business and loyal returning customers

Their success is built on transparency, communication, and execution — qualities often missing from older firms that rely too much on brand name.

Transparent Pricing Model

GoldenCrest is one of the few companies that offers a straightforward, flat-rate fee structure.

Here's a breakdown:

| Fee Type | Details |

|---|---|

| Account Setup | Often waived during promotions |

| Annual Maintenance | Flat rate – no hidden asset-based fees |

| Storage Fees | Competitive, based on depository choice |

| Minimum Investment | $10,000 for new accounts |

This transparency is a major selling point — especially for investors tired of confusing custodial costs or sliding-scale fees that penalize portfolio growth.

GoldenCrest Metals Fees – No Surprises, Just Straightforward Pricing

One of the biggest concerns for retirement savers exploring precious metals IRAs is the fear of hidden fees and confusing custodial structures. GoldenCrest takes a radically transparent approach to pricing — no surprise invoices, no percentage-based asset fees, and no upselling of overpriced collectibles.

Here’s how their fee structure breaks down:

| Fee Category | Details |

|---|---|

| Account Setup | $50–$100 (often waived with qualifying investment or promotions) |

| Annual Maintenance | $100–$175 flat rate (covers administration and reporting) |

| IRA Custodian Fees | Varies by custodian; typically $80–$100/year |

| Storage Fees | From $100/year depending on metal type and depository selection |

| Metal Markup | Competitive pricing close to spot; clearly disclosed before purchase |

| Minimum Investment | $10,000 for new IRA accounts |

✅ No scaling fees based on account size — whether you invest $10,000 or $500,000, your administrative fees remain consistent.

✅ No commissions on buybacks — GoldenCrest offers competitive market-based repurchase pricing without extra charges.

Storage Options – Safety, Flexibility, and Full IRS Compliance

GoldenCrest Metals provides clients with multiple secure, IRS-approved storage solutions for holding physical gold, silver, and other precious metals.

Their trusted network includes depositories across the U.S. that specialize in precious metals custody and offer both segregated and non-segregated options.

🏢 Depository Partners & Locations

GoldenCrest works with several top-tier vaults, including:

- Delaware Depository (Delaware)

- Brink’s Global Services (Salt Lake City, UT & Las Vegas, NV)

- IDS of Texas (Dallas, TX)

All depositories are:

- 🔐 Fully insured through Lloyd’s of London or equivalent

- 🔎 Subject to routine audits and reconciliations

- 🛡️ Compliant with IRS and IRS-approved IRA custodians

You can also request documentation confirming the existence and location of your assets — a key feature that boosts peace of mind.

PROS

✅Trusted by thousands of retirement savers 50+

✅Fast rollover processing (as little as 48 hours)

✅Lifetime customer support

✅Offers both traditional and Roth Gold IRAs

CONS

⭕Newer than legacy brands, so fewer total reviews online

⭕$10,000 minimum investment

The company's commitment to customer service, flexibility, and expertise in the field of physical precious metal investment makes them an attractive option for individuals looking to diversify their retirement portfolios. With a range of IRA options, including the ability to choose between various metals and storage options, Golden Crest Metals is a trusted and reliable partner for precious metal investing.

GET YOUR FREE GOLD IRA GUIDE NOW!Read my review on GoldenCrest Metals

#2 — Colonial Metals Group

Best for: Clients who value institutional stability and conservative wealth strategies

With a reputation built on discretion, security, and conservative asset allocation, Colonial Metals Group is quickly becoming a preferred choice among retirement savers seeking stability over hype.

While not as widely advertised as some competitors, Colonial has carved out a loyal client base through word-of-mouth referrals, personalized guidance, and strict adherence to compliance and industry best practices.

Highlights:

🔄 Direct rollover assistance for qualified plans and existing IRAs

🪙 Access to IRS-approved bullion and coins in gold and silver

🧾 IRS-compliant custodial coordination

📚 Personalized asset guidance based on each client’s risk profile

🔍 No pushy sales tactics — just facts and fiduciary-minded advice

Company Profile

| Category | Details |

|---|---|

| BCA Rating | A– (Business Consumer Alliance) |

| BBB Complaint History | No significant complaints or unresolved cases |

| TrustLink Rating | 4.8 stars (based on verified user feedback) |

| Industry Reputation | Strong among high-net-worth and conservative investors |

| IRA Policies | Supports Traditional, Roth, SEP, SIMPLE IRAs; accepts 401(k), 403(b), TSP |

| Precious Metals Offered | Gold and Silver (bullion & IRA-approved coins only) |

| Fees | Flat annual fees for maintenance and storage; no asset-based % charges |

| Minimum Investment | $20,000 |

Professional Assessment

Colonial Metals Group may not dominate headlines, but among industry analysts and retirement advisors, it’s earned a quiet but formidable reputation. According to a 2025 review by Retirement Vault Insights, Colonial is “the thinking investor’s choice — less flash, more substance.”

Their approach is rooted in conservative asset preservation, and they’ve built trust by focusing on long-term relationships over marketing gimmicks.

💬 Key Expert Takeaways:

✅ Discreet reputation: Trusted by high-net-worth individuals and family offices seeking wealth protection without the media spotlight.

✅ Compliance-driven: Known for meticulous attention to IRS guidelines, custodial coordination, and proper reporting practices.

✅ Conservative strategy: Emphasizes capital preservation through gold and silver bullion, avoiding speculative products.

✅ Client experience: Highly rated for clear communication, no-pressure consultations, and steady follow-through during rollovers.

✅ Secure custody: Works with top-tier vaults in Delaware, Texas, and Utah—fully insured and IRS-compliant.

⚠️ Considerations:

- Higher minimum investment ($20,000): May be less accessible for entry-level investors or those just starting retirement diversification.

- Low media visibility: While respected in financial circles, Colonial lacks the brand awareness of more heavily marketed competitors.

- Limited product range: Focuses exclusively on gold and silver; those seeking platinum or palladium may need to look elsewhere.

What Colonial Metals Group Offers

Colonial Metals Group provides full-service support for individuals looking to roll over their traditional retirement accounts — including 401(k), TSP, 403(b), 457, and pension plans — into self-directed precious metals IRAs.

Their offerings include:

- 🔄 Direct rollover assistance for qualified plans and existing IRAs

- 🪙 Access to IRS-approved bullion and coins in gold and silver

- 🧾 IRS-compliant custodial coordination

- 📚 Personalized asset guidance based on each client’s risk profile

- 🔍 No pushy sales tactics — just facts and fiduciary-minded advice

Colonial Metals Group is particularly appealing to retirees, business owners, and conservative investors looking to preserve capital without exposure to Wall Street speculation.

Colonial Metals Group’s Transparent Approach

Colonial Metals Group positions itself as a low-noise, high-integrity alternative to aggressive sales-driven companies. Their approach is based on strategic preservation of purchasing power, not short-term market timing.

Here’s what makes them unique:

- Institutional-style approach to wealth protection

- One-on-one retirement consultations, not call center queues

- Extensive research and educational tools

- Focus on security, insurance, and compliant metals allocation

- Ideal for 401(k) to Gold IRA rollovers, even from inactive plans

Their philosophy is simple: protect what you’ve earned with tangible, real-world assets, not promises on a screen.

Reputation & Client Feedback

Colonial Metals Group may fly under the radar compared to some high-profile firms, but their reputation in professional circles is well established.

- Positive feedback from long-term clients (especially 50+)

- No major regulatory issues or BBB complaints

- TrustPilot rating is amazing, average rating is 4.5

- Emphasis on education, not hype

- Increasing popularity among wealth advisors and family office clients

Fee Structure Overview

Colonial Metals Group follows a conservative flat-fee model, with no performance-based pricing or hidden asset charges.

| Fee Category | Details |

|---|---|

| Account Setup | $50–$100 (may be waived depending on account size) |

| Annual Maintenance | $150–$175 (fixed, not tied to portfolio value) |

| Storage Fees | $100–$150/year depending on depository |

| IRA Custodian Fees | Determined by chosen custodian (typically $80–$100/year) |

| Minimum Investment | $20,000 |

💡 Colonial’s minimum is slightly higher than competitors, but their clientele generally includes higher-net-worth individuals looking for stability and discretion.

Storage Options

Colonial Metals Group partners with established vaulting services and custodians, offering both segregated and pooled storage options in fully insured facilities.

Key details:

- Vaults located in Texas, Delaware, and Utah

- Choice between segregated (personalized) and non-segregated (pooled)

- Full IRS compliance + annual audits

- Transparent third-party verifications available on request

All storage accounts are insured and monitored for physical integrity and inventory reconciliation.

PROS

✅Trusted by conservative, high-net-worth investors.

Known for quiet professionalism and long-term client relationships rather than flashy marketing.

✅Transparent fee structure. Flat-rate annual pricing makes it easy to forecast long-term costs without surprise charges.

✅Strong compliance reputation. Works closely with IRS-approved custodians and vaults; prioritizes regulation and reporting accuracy.

✅Specializes in retirement rollovers. Deep experience with 401(k), 403(b), TSP, and pension-to-IRA transfers.

✅Segregated storage options. Secure vaulting in Texas, Delaware, and Utah with full insurance coverage.

CONS

⭕Higher minimum investment ($20,000). May not be accessible to investors just starting out or testing the waters with gold IRAs.

⭕Limited product variety. Primarily offers gold and silver; no platinum, palladium, or numismatics for collectors.

⭕Lower brand visibility

Less known to the general public, which may deter investors looking for household names.

Read my review on Colonial Metals Group

#3 — Noble Gold Investments

Best for: First-time Gold IRA investors and budget-conscious retirement savers

Founded in 2016 and headquartered in Pasadena, California, Noble Gold Investments has become a household name in the gold IRA space — especially for those seeking simplicity, transparency, and strong customer support.

Unlike some competitors, Noble Gold balances its offerings between education, affordability, and straightforward account setup. It's one of the few firms that provides both IRA services and direct-to-consumer precious metals with exclusive home delivery options.

Highlights – Why Investors Choose Noble Gold

🧭 Step-by-step onboarding for retirement savers new to gold

💼 IRA specialists assist with 401(k), 403(b), TSP, and SEP rollovers

🪙 Offers IRA-approved bullion plus collector-grade coins

💸 Low investment minimums and flat annual fees

🏦 Depository options in Texas and Delaware, fully insured

Company Profile

| Category | Details |

|---|---|

| BCA Rating | A+ (Business Consumer Alliance) |

| BBB Complaint History | Very few complaints; mostly resolved quickly |

| TrustLink Rating | 4.9 stars (1,000+ verified reviews) |

| Industry Reputation | Strong reputation for client education and service |

| IRA Policies | Supports Traditional, Roth, SEP, SIMPLE IRAs + 401(k), 403(b), and TSP rollovers |

| Precious Metals Offered | Gold, Silver, Platinum, Palladium + numismatic coins |

| Fees | Flat, transparent fees for account setup and storage |

| Minimum Investment | $10,000 for IRAs, $5,000 for direct cash purchases |

Professional Assessment

Financial analysts at Metals Insight Weekly rank Noble Gold as “one of the most user-friendly firms in the IRA space”, especially for first-time buyers or younger investors exploring physical metals.

💬 Key Expert Takeaways:

✅ Educational onboarding: New clients are walked through each step of the rollover process with zero pressure.

✅ Straightforward service model: No third-party custodial confusion — everything is explained clearly.

✅ Rare flexibility: Offers both investment-grade bullion and collector coins, plus home delivery options.

✅ Strong support track record: Thousands of verified 5-star reviews on TrustLink and Consumer Affairs.

⚠️ Considerations:

- Noble offers numismatics (rare coins), which are not always suitable for strict IRA use

- Live pricing not available online — clients must speak to an advisor for updated quotes

Noble Gold Fees – Simple, Transparent, and Competitive

Noble Gold makes it easy to understand your costs from the start. There are no percentage-based fees or hidden markups.

| Fee Category | Details |

|---|---|

| Account Setup | $80 (one-time) |

| Annual Maintenance | $150 for administration + $100 for storage (flat, not asset-based) |

| Custodian Fees | Included in the annual package |

| Metal Markup | Transparent, based on market spot pricing |

| Minimum Investment | $10,000 (IRA), $5,000 (non-IRA cash deals) |

Noble Gold is one of the few companies that clearly explains its fees on the first call — no hidden fine print or aggressive upselling.

Reputation & Client Feedback

Noble Gold enjoys one of the strongest reputations in the industry among both new and seasoned precious metals investors. With thousands of five-star reviews and a strong Better Business Bureau profile, it’s become known as a company that prioritizes clarity, education, and reliability.

Here’s how Noble Gold ranks among major review platforms:

- ⭐ BBB Rating: A+ with minimal complaints and prompt resolution history

- 🧾 TrustLink: 4.9 out of 5 stars based on 1,000+ verified reviews

- 📢 ConsumerAffairs: Consistently praised for low-pressure consultations and helpful reps

- 💬 Google Reviews: Clients regularly highlight fast account setup and easy rollovers

One recurring theme in Noble Gold’s feedback is “no surprises” — customers know what to expect, understand their fees upfront, and feel supported during every step of the process.

This reputation has made Noble Gold especially popular with retirement savers new to physical metals, who may feel overwhelmed by other companies’ complex structures or aggressive sales calls.

Storage – IRS-Compliant and Secure Vaulting

Noble Gold partners with some of the most respected IRS-approved depositories in the U.S., offering both segregated and non-segregated storage:

- International Depository Services (IDS) of Texas – Segregated, insured vaults in Dallas

- Delaware Depository – Longstanding compliance and full audit controls

- Metals are fully insured, audited, and stored under your name

- Optional “Survival Packs” available for direct home delivery (non-IRA)

You can access documentation of your holdings and storage status anytime via your custodian.

PROS

✅Low entry point: Only $10,000 required to open a gold IRA

✅Exceptional customer reviews and BBB reputation

✅Transparent, fixed-fee pricing model

✅Offers platinum and palladium IRAs as well

✅Exclusive “Survival Pack” option for at-home precious metals storage

CONS

⭕No pricing dashboard — you must speak with an advisor for live quotes

⭕Offers collectible coins, which can confuse some IRA buyers

⭕May not offer the high-end, concierge-style experience of newer boutique firms like GoldenCrest Metals

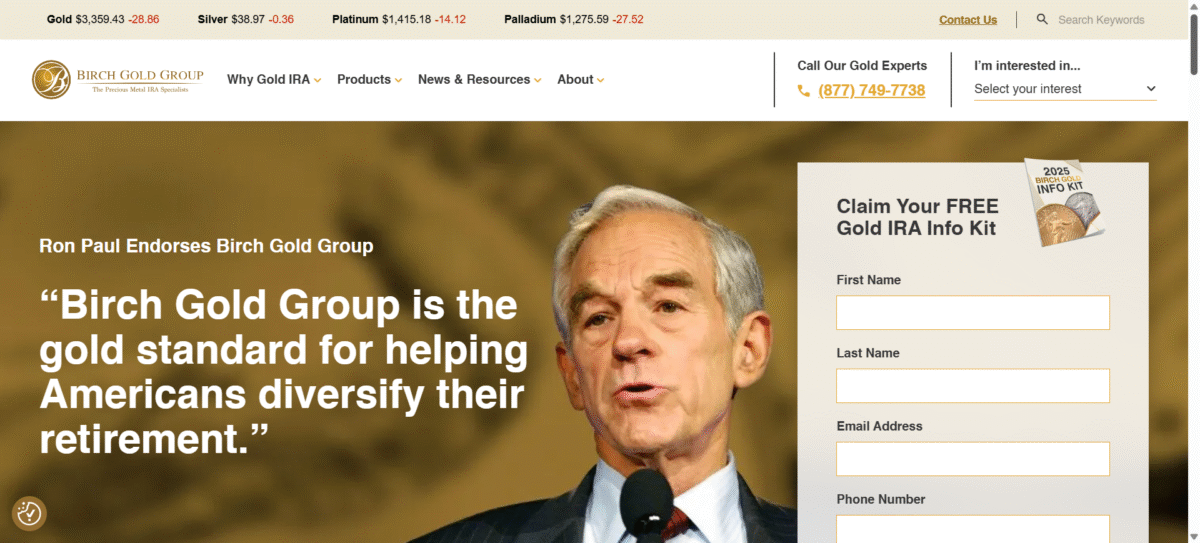

#4 — Birch Gold Group

Best for: Retirement savers who want credibility, long-term experience, and direct access to U.S.-minted coins

Founded in 2003 and headquartered in Burbank, California, Birch Gold Group is one of the most established names in the precious metals space. The company is known for its strong media presence, including regular appearances on Fox Business and endorsements from conservative voices like Ben Shapiro.

With over two decades of experience, Birch Gold has helped thousands of Americans move retirement funds into physical assets like gold, silver, platinum, and palladium. Their team includes former financial advisors, wealth managers, and IRA specialists, which appeals to investors who want a well-rounded, consultative approach to wealth protection.

Highlights – Why Retirement Savers Choose Birch Gold

🏛️ Founded in 2003 — one of the most experienced firms in the gold IRA industry

🎙️ Endorsed by Ben Shapiro and featured on major media outlets

📚 Offers comprehensive investor education and in-depth market analysis

🪙 Wide range of IRS-approved metals, including platinum and palladium

💰 $10,000 minimum investment makes it accessible to most investors

🏦 Secure, insured storage through Delaware Depository and Brinks

Company Profile

| Category | Details |

|---|---|

| BCA Rating | AAA (Business Consumer Alliance) |

| BBB Complaint History | A+ rating with a low number of complaints, most resolved swiftly |

| TrustLink Rating | 4.8 stars from over 1,000 reviews |

| Industry Reputation | Long-standing presence, conservative audience, endorsed by top commentators |

| IRA Policies | Traditional, Roth, SEP, SIMPLE IRAs; rollovers accepted from 401(k), TSP, 403(b) |

| Precious Metals Offered | Gold, Silver, Platinum, Palladium |

| Fees | Transparent setup and annual fees; no commission on buybacks |

| Minimum Investment | $10,000 |

Professional Assessment

According to Financial Safeguard Review (2025), Birch Gold stands out as a “legacy firm with unmatched reputation and consistent delivery of value.” The company’s education-first approach and conservative brand appeal make it a great fit for retirement savers concerned about inflation, market crashes, and fiat currency instability.

💬 Key Expert Takeaways:

✅ 20+ years of experience in helping clients roll over retirement accounts

✅ Heavily endorsed and media visible, especially in conservative circles

✅ Diversified metals offering, including platinum and palladium

✅ Strong compliance record and BBB standing

⚠️ Considerations:

- May not appeal to investors looking for boutique-style personalization

- Live pricing not shown on the site — requires a consultation

- Large customer base can result in longer wait times for reps during peak demand

Birch Gold Fees – Transparent and Competitive

Birch Gold keeps its pricing model simple and competitive. All fees are disclosed up front during your initial consultation.

| Fee Type | Details |

|---|---|

| Account Setup | $50–$100 (may be waived during promos) |

| Annual Maintenance | $180–$200 for administration + storage |

| Custodian Fees | Usually included in annual pricing |

| Storage Fees | Flat rate, not based on portfolio size |

| Minimum Investment | $10,000 for new IRA accounts |

No commission is charged on buybacks — Birch will repurchase metals at the current market rate when clients are ready to sell.

Reputation & Client Feedback

Birch Gold is one of the most widely-reviewed firms in the industry, with glowing feedback from clients who value trust, security, and education.

- ✅ A+ BBB rating and accreditation

- ⭐ 4.8 TrustLink score from over 1,000 verified customers

- 📈 Frequent praise for no-pressure reps and follow-through

- 🗣️ Widely recommended by financial commentators and conservative radio hosts

Common client feedback includes phrases like “felt in control,” “fully informed,” and “appreciated the honest approach.”

Birch's reputation for consistency has made it a top pick for both first-time and experienced retirement savers across the U.S.

PROS

✅Excellent reputation and long track record (since 2003)

✅Strong media presence and endorsements from trusted public figures

✅Competitive, transparent fees

✅Platinum and palladium options included

✅$10,000 minimum makes it beginner-friendly

CONS

⭕Live metal pricing not displayed online

⭕Less flexibility in storage options compared to boutique providers

⭕No cryptocurrency or alternative asset options

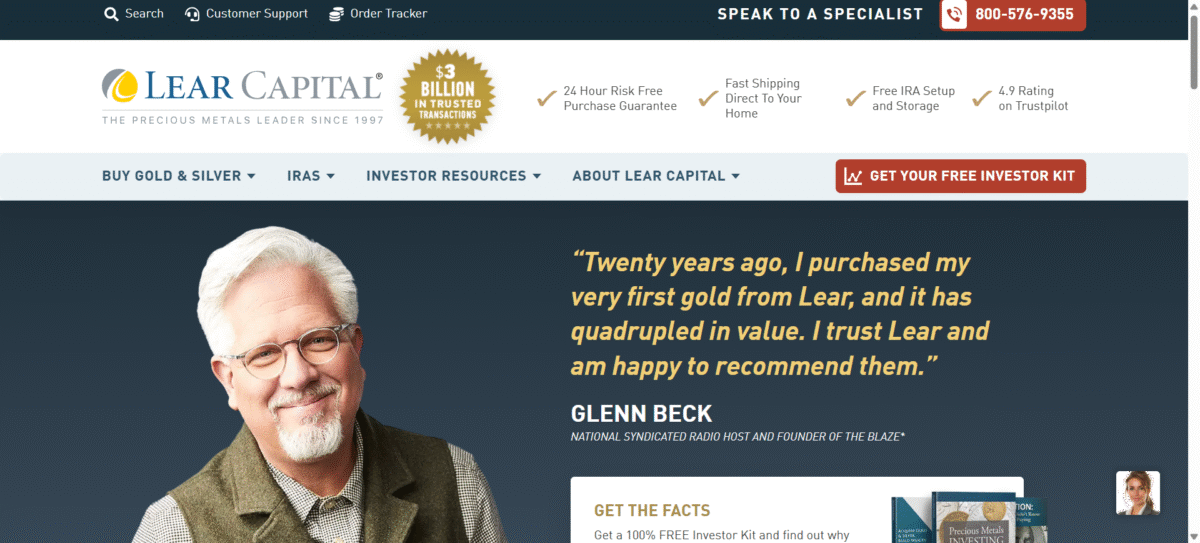

#5 — Lear Capital

Best for: Retirement savers who value brand recognition, buyback assurance, and diverse metals offerings

Founded in 1997 and headquartered in Los Angeles, Lear Capital is one of the most recognizable names in the gold IRA industry. With over two decades of experience, they’ve served more than 90,000 customers and processed over $3 billion in precious metals transactions.

While Lear has faced regulatory challenges in the past, the company has taken steps to rebuild trust through improved fee transparency, stronger compliance measures, and a renewed focus on investor education.

Today, Lear Capital continues to be a popular choice for retirees seeking IRA rollovers, diversification strategies, and a guaranteed buyback policy that allows clients to liquidate metals without penalty.

Highlights – Why Choose Lear Capital?

🏛️ Founded in 1997 – over 25 years of industry experience

💼 IRA specialists handle 401(k), TSP, and pension plan rollovers

🔙 Guaranteed buyback program for added liquidity

📊 Online tools: Portfolio calculator, RMD estimator, and price charts

📞 Free one-on-one consultations and educational resources

Company Profile

| Category | Details |

|---|---|

| BCA Rating | A (Business Consumer Alliance) |

| BBB Complaint History | A+ rating, with prior settlements related to fee disclosures |

| TrustLink Rating | 4.7 stars from over 900 reviews |

| Industry Reputation | Long-standing brand with widespread recognition and restructured compliance |

| IRA Policies | Traditional, Roth, SEP, SIMPLE IRAs; accepts 401(k), 403(b), and TSP rollovers |

| Precious Metals Offered | Gold, Silver, Platinum, Palladium, select numismatics |

| Fees | Published fee structure; updated transparency post-FTC settlement |

| Minimum Investment | $10,000 |

Professional Assessment

According to analysts at IRA Gold Authority (2025), Lear Capital remains “one of the most visible and educationally supportive brands in the industry,” especially useful for investors who prefer online tools and calculators during the decision-making process.

💬 Key Expert Takeaways:

✅ Long history and infrastructure — Over $3B in transactions and a team trained in rollover logistics

✅ User-friendly tech — Online calculators, charts, and learning centers not found with most competitors

✅ Buyback guarantee — Ensures metals can be resold quickly at market value

✅ Improved compliance — Post-FTC scrutiny led to more transparent contracts and sales scripts

⚠️ Considerations:

- Past legal issues: Lear reached a settlement with the FTC in 2022 regarding disclosure practices — since addressed

- Higher advertising presence may make some clients skeptical of sales motivation

- Some customer service complaints cited slow response during peak times

Lear Capital Fees – Now More Transparent

Lear has revamped its pricing approach following FTC oversight, offering more clear and upfront cost breakdowns than in the past.

| Fee Type | Details |

|---|---|

| Account Setup | $50–$100 (waived in some promotions) |

| Annual Maintenance | $160–$200 including custodian and storage |

| Custodian Fees | Included; worked out through Equity Trust or STRATA Trust |

| Metal Pricing | Transparent markups disclosed during consultation |

| Minimum Investment | $10,000 |

💡 Tip: Ask about promotions that waive fees for the first year when you invest over $25,000.

Reputation & Client Feedback

Lear Capital has rebuilt much of its reputation in recent years through improved disclosures, transparent pricing, and a renewed focus on education.

- ⭐ A+ BBB rating (though past cases are publicly documented)

- 💬 TrustLink: 4.7/5 stars from nearly 1,000 verified clients

- 📈 Featured in MarketWatch, Nasdaq, Bloomberg, and Financial Times

- 🛠️ Client support has improved post-FTC with additional training and compliance oversight

Many clients highlight the company’s helpful onboarding tools, simple rollover process, and real-time support.

Still, some investors recommend reading all documents carefully and requesting written fee disclosures — a best practice with any firm.

Storage Options – IRS-Approved & Fully Audited

Lear Capital offers IRS-compliant storage through high-security vaults in the U.S., fully insured and monitored.

- 🏦 Delaware Depository – Industry standard, fully insured by Lloyd’s of London

- 🔐 Choice of segregated or non-segregated storage

- 📋 Third-party audit reports available

- 🔄 Lear will coordinate logistics and asset tracking through your IRA custodian

Metals are stored under your IRA’s name, not Lear’s — ensuring legal compliance and peace of mind.

PROS

✅Long history and nationwide brand recognition

✅IRA-compatible gold, silver, platinum, and palladium products

✅Helpful calculators, price charts, and learning tools

✅Guaranteed buyback program adds liquidity

✅Multiple custodians and secure storage options

CONS

⭕Regulatory history may concern cautious investors

⭕Some clients report pushy sales tactics during consultations

⭕No live metal pricing on the site — requires contacting a rep

Ranking Criteria for Top Gold IRA Companies:

- Reputation and Reviews

To rank the top gold IRA companies, we considered several factors. The first factor was reputation and reviews, which was assessed by checking the Better Business Bureau ratings and reviews of each company. The companies that made it to the list had BBB ratings of B or higher and mostly received positive reviews.

In addition to the Better Business Bureau, other important organizations were also considered when ranking the top gold IRA companies. The Business Consumer Alliance (BCA), TrustLink Rating, and Consumer Affairs were evaluated to gain a more comprehensive understanding of each company's reputation and customer satisfaction. The evaluators also looked into the ease of setup, costs and fees (including setup fees, storage fees, and maintenance fees), selection of gold and silver products, commissions, and potential buybacks. - Ease of Setup

Another factor considered was the ease of setup. Reliable precious metal IRA companies offer an easy and stress-free process to gain new clients, and they provide qualified assistance from investment professionals. The top gold IRA companies on the list feature easy setup processes and direct access to specialists throughout the account-opening process. - Costs and Fees (commissions, setup fees, storage fees, maintenance fees)

Costs and fees were also taken into account. Most gold IRA companies charge fees for their services, such as setup fees, storage fees, and maintenance fees. The top gold IRA companies charge reasonable fees for their services, avoiding companies that offer free services or those that charge outrageously high fees. - Selection of Gold and Silver Products

The selection of gold and silver products offered by the company was another factor in determining the top gold IRA companies. It is essential to work with a company that offers a diverse selection of gold, silver, and other precious metal products to allow clients to diversify their investment portfolios. The top gold IRA companies offer varied selections of precious metal products, including coins and bars. - Potential Buybacks

Potential buybacks were also considered in the ranking of the top gold IRA companies. Some companies offer buybacks, which allow clients to sell their precious metals back to the company without incurring additional fees. The best gold IRA companies offer easy and reliable buybacks, and several of the companies on the list provide this feature.

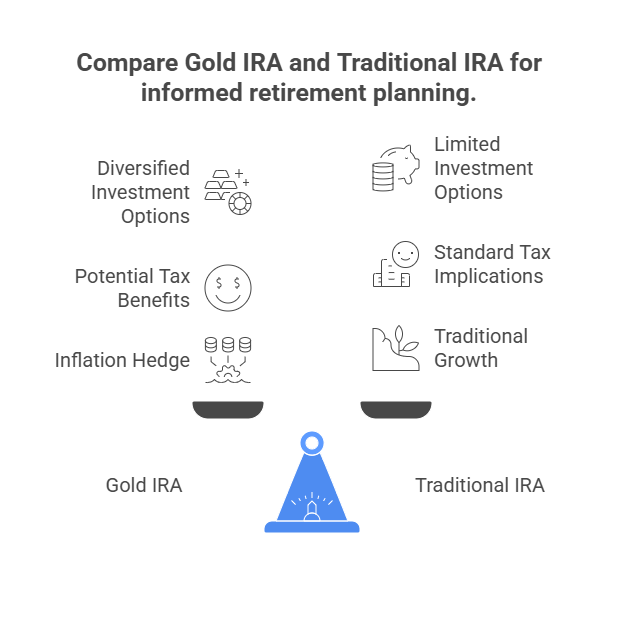

What is a Gold IRA?

A gold IRA is simply a self-directed IRA used for the tax-deferred purchase of physical precious metals. These accounts follow the same rules and regulations as other traditional or Roth IRA accounts. Americans can make regular tax-deferred financial contributions to grow their retirement savings, or roll over funds from another qualifying retirement account.. A gold IRA is a unique tax-advantaged way for Americans to buy physical precious metals.

It’s important to know that not all precious metals are eligible for inclusion in a self-directed “gold” IRA. Your gold dealer along with your gold IRA custodian can help in the selection of metals and ensure all purchases are IRS-compliant. Choose the wrong coin and risk having your IRA disqualified.

Buy Physical Precious Metals IRA

Investing in gold for retirement is a popular choice, and one way to do so is through a Physical Precious Metals IRA. Gold bullion, which refers to gold coins and bars, is a common option for those interested in purchasing gold. The purity, maker, and weight of the bullion should be stamped on the front face of the bar, with the typical unit of sale being the gram or ounce.

When purchasing gold bullion for investment purposes, it’s essential to ensure that it contains at least 99.5% of the precious metal, especially if you plan to keep the coins and bars in your gold IRA account. Any gold that does not meet this 99.9% purity requirement can not be stored in an IRA.

You may see American Eagle coins advertised for inclusion in an IRA. Congress has made an exception for both the bullion and proof versions of this coin. Note that American Eagle proofs often come at a higher price than most bullion productsand contain a lower percentage of gold. For instance, the one-ounce American Eagle coin contains only 91.67% gold, with the remaining weight consisting of silver and copper.

Physical or “Paper” Gold?

Investing in gold mining stocks is another way to invest in gold for retirement. However, it’s important to note that gold stock prices are based not only on the price of gold but also on the profitability and expenses of the mining company. As a result, investing in individual gold mining companies carries the same level of risk as investing in any other publicly traded company and not necessarily the underlying physical metal.

While gold ETFs may closer follow the spot price of gold, you’re again investing in a company and trusting in third party variables such as the management of this Exchange Traded Fund. ETFs are easy and convenient to buy and sell, but not the same as directly buying and holding physical gold and silver.Investing in a gold IRA is in my opinion, the best option for diversifying your retirement portfolio on a tax-deferred basis while maintaining favorable tax treatment. If you choose to move or rollover a portion of your existing IRA account into a gold IRA account, there will be no tax ramifications.

Gold IRA Rollover

Back in high school, I was considered pretty sharp, but life has a way of taking the wind out of your sails.

I found myself becoming a progressively smaller fish in a larger sea.

As I began to approach retirement, I realized that I might face a real struggle with maintaining a fairly comfortable lifestyle.

A possible longer lifespan, escalating medical bills, the economic turmoil of the last few years and supporting family members in various endeavors have taken their toll on what was once a pretty sound financial profile.

Investors typically have options in how to invest wealth or savings, but most traditional 401(k)s are limited in choices for diversifying and controlling your money directly.

You now have the right to roll over your IRA or employer-sponsored 401(k) plan into a self-directed IRA where you can choose investments, diversify your retirement strategy and even invest in a plan based on gold and precious metals.

Gold IRAs are funded by buying gold and storing it with a custodian who verifies its purity and keeps it secure until retirement or withdrawal. You can invest in bullion or gold coins and enjoy the benefits that gold investing has delivered to thousands of customers worldwide.

Why Consider a Gold IRA Rollover?

Gold provides signature benefits over other types of investments for practical, strategic and historical reasons. Gold’s value has appreciated steadily for millennia, and people, governments and business experts have always recognized its intrinsic value.

Historically, gold’s value has always outpaced inflation and delivered remarkable, verifiable returns for investors.

Hundreds of the world’s wealthiest and most savvy investors commit large percentages of their resources to gold to diversify their portfolios, hedge against inflation and protect their portfolios against paper-asset collapses.

The benefits of starting a gold IRA include:

- The value of gold will never drop to zero because gold has artistic and manufacturing value.

- Gold tends to perform well when currencies and stocks drop in value, so investing in gold is a great way to diversify your assets.

- Demand for gold in India and China is increasing due to the expanding number of manufacturing processes that use gold.

- Gold IRAs protect your retirement income from inflation, economic collapses and disaster scenarios such as wars, riots and currency collapses.

Gold IRAs Strengthen Your Financial Profile for Retirement

I had never considered taking control and choosing my own investments in a self-directed IRA. I didn’t even know that I could do so until a friend explained it to me.

After studying the market conditions, past performance and recommendations of hundreds of online financial advisors, I became convinced that a gold IRA rollover made sense for maximizing my retirement income with minimal risk.

If you decide to invest in gold, choosing the safest gold IRA company remains a concern.

I’m including reviews of the top five gold IRA companies to help you decide where to invest.

Don’t just take my word on something so important to your retirement security and comfort — I’ve also included summaries of the ratings of top consumer watchdog agencies and other reviewers.

Unlike the chaotic Gold Rush days in the Yukon, you can join the rush to invest in gold IRA rollovers after pragmatic study and careful planning.

A Brief History of Gold as an Asset

Throughout history, gold has been commonly used as a form of currency and trade. It was first used as a currency around 500 BC by Darius the Great, the ruler of the Persian Empire. He introduced the “daric,” the first gold coin, to support his army's expansion into other regions. Until the last century, several countries worldwide used gold and silver coins as money. However, governments abandoned the gold standard in the 1930s during the global economic downturn.

While gold has a long history of being associated with monetary systems, it stopped playing this role in already established economies after the Second World War. The Bretton Woods monetary system was established after the war, which created a fixed exchange rate system. However, this system ended in 1971 when the United States unilaterally decided to abolish its gold standard, setting the exchange rate between gold and the dollar at US$35 per ounce.

In recent years, gold has experienced a resurgence as a popular investment asset, particularly in times of economic uncertainty. During the COVID-19 pandemic, for example, the price of gold reached a record high as investors sought a safe haven asset amidst the volatility of the stock market. Additionally, several central banks have been increasing their gold reserves, including those of China, Russia, and India. As of 2023, the price of gold continues to fluctuate based on various economic and geopolitical factors.

A Gold IRA Offers The Greatest Potential Profits

Take a moment to stop and think about it. What is the fundamental motivation for any type of investment? Profit, of course! Thus, boosting the bottom line of your retirement savings account must remain the sole overriding objective at all times for all investments.

Gold is the one commodity that has consistently withstood Father Time’s lengthy rigorous tests and whimsical winds. Indeed, Father Time himself has repeatedly told the tale of the remarkable resilience of gold. His wise words are there for the viewing of any historical performance graph or chart. Let’s quickly review a few excerpts from this long-running saga right now.

Additional advantageous aspects of gold IRA investments

• Flexibility

A gold IRA is classified as a “self-directed” retirement savings scheme. As the label suggests, investors have the full and final say-so about when, where, and how to invest their hard-earned funds. Thus, you may freely adjust your market strategies to conform to whatever conditions may prevail. By stark contrast, most conventional IRAs are managed by distant disinterested third parties with little motivation to make necessary tweaks, shifts, and fine-tuning to maintain optimal performance of YOUR retirement investment account.

• Durability

Even most infants can readily discern that metal is much sturdier than mere paper. This relative physical strength differential also remains a constant in fiscal contexts. In fact, the current existence of over 95 percent of all gold ever mined since the beginning of time is tacit yet powerful testimony of its uncanny durability. Besides being a comparative blip on the radar screens of Investment Life Expectancy, paper is just a baby in terms of Investment Basis History.

While gold has been the foundation of national currencies for several millennia, paper-based negotiable instruments were born just a few centuries ago. This extreme age difference has definite investment implications, such as:

• Versatility

Believe it or not, gold has many faces that appear in many shapes and forms. Besides its well-known bullion, coinage, and bar personas, gold hides inside a wide variety of items and instrumentalities of little-known association. Its widespread integration into chemical, electronic, beverage, food, and even medical supply products virtually guarantee a perpetually high demand for this scarce metallic substance. As always, of course, the Law of Supply and Demand dictates a single long-term direction for its value: up.

No paper-based “asset” category can credibly boast the same, however. Stock, bond, and mutual fund certificates are subject to mass duplication that affects equally swift massive value declines. Moreover, have you ever heard of paper being part of a lifesaving heart pacemaker? How long do you think paper would last inside a calculator, PDA, GPS system, cell phone, or TV? Do you have difficulty envisioning a stock certificate as an indispensable component of computer microprocessors, industrial machinery, or tooth fillings? Gold has proven superior to all these tasks, however.

Gold IRA Investments and Inflation

A famous Shakespearean quote quips, “The best-laid plans of mice and men often go awry.” This age-old social observation is also quite accurate in the context of modern situations. Whether or not you realize it, an invisible enemy constantly lurks about and lies in wait to deflate the value of even the most well made investment portfolios.

“Inflation” is its name and slow-motion murder is its game. Before reaching for your gun, relax. This particular foe is no imminent or physical threat to your personal safety. Rather, Inflation is a patient fiend that takes decades to do devastating damage to your pecuniary health. The following example provides clear and convincing evidence of Inflation’s modus operandi:

In 1913, the average price for a loaf of bread was 6 cents. Nearly a century later in 2008, a loaf of bread set the average grocery shopper back $1.37. These figures reflect a whopping 2,246 percent price increase. Do you think that a national bread fetish caused this quantum leap in apparent bread value? Did some official directive mandate that wheat farmers must price gouge the public? Did a persistent 95-year locus infestation of wheat crops create a severe bread scarcity that invoked supply and demand laws to decree a 22-fold price increase? None of the above is the accurate answer to this economic enigma.

Instead, Inflation was the real culprit all along. In actuality, bread had no more intrinsic value in 2008 than it did 9 ½ decades earlier. Nor did any significant change in bread supply or demand occur. Neither was any legislative act to blame by any means.

Although its nominal price took a major hike, the real price of bread stayed the same from 1913 to 2008. What really happened is that the value of the currency used to buy the bread took a gradual but major dive. Thus, more devalued money become required to acquire the same a loaf of bread. Inflation’s dirty work is not limited to bread, however. It affects all product and commodity categories. Unfortunately, the budgetary havoc wreaked by inflation is unavoidable.

Fortunately, however, a very effective weapon exists to defeat this pecuniary pest named “gold.” During the same 1913-to-2008 time frame, the price of gold rose from $18.92 to $871.96 — an incredible increase of 4,500 percent that reflects a whopping 46-fold rise. This figure is more than double the relatively puny price hike of bread. In practical terms, this means that 1913 grocers would have been best advised to accept gold coins for bread. While the miniscule 6-cent payment they took instead is practically worthless today, the current value of a tiny gold coin that is thousands of times higher buys much more than one loaf of bread.

The foregoing illustration should evoke a major altered perception to put Inflation in its proper place – in the distant background of the Big Picture of Gold Investment Performance.

Perpetual political neutrality

Non-partisanship is another hugely advantageous gold attribute. Unlike voters, gold is impervious to the ever-changing climes and wiles of politics and hollow promises of hopeful public office holders. Whenever things start looking a little rough in the rough and tumble business world, investors make a mass stock market exodus. This frequently starts a self-sustaining cycle of capital deficiencies in research and development realms.

Such stagnation of empirical investigation into potential innovations that could save the day for struggling corporations has worse implications for the value of paper stocks on which they are built. This in turn leads to even greater investor hesitation to touch such marginal firms with a ten-foot pole. Much like the famous Energizer Bunny, this vicious cycle keeps going and going and going….

Until the whole house of cards inevitably collapses like it did back in 1929. Such bleak circumstances are very good news for gold investors, though. This is due to the predictable imminent bum rush of their preferred market by timid speculators seeking shelter from merciless stock market storms. As usual, the Law of Supply and Demand immediately dictates an instant incredible rise in the value of their gold IRA investments.

Federal Reserve’s financial role

Likewise, when the U.S. Federal Reserve Board announces its intention to raise interest rates a tad or two, it incites terror in the hearts of paper investors. Why? Because they realize the repercussions of such an official move on private monetary markets. Unemployment will soon begin to grow by leaps and bounds. Meanwhile, consumers will postpone major purchases until a much later date because of financial infeasibility due to higher interest rates. These concurrent circumstances combine to create a very depressing picture for prevailing economic conditions. The dismal portrait features currency deflation, widespread business bankruptcies, and so on. For all they know, the devastating trickle-down effects could cause permanent closure of the company(ies) in which they currently hold a significant share of “prime” stock.

Gold owners never worry about such things, because a combination of fixed supply and widespread applications make their precious metallic investments permanently immune to such monetary market “monkey wrenches.”

Frequently Asked Questions about Precious Metals IRAs

What are the benefits of buying gold and silver within an IRA?

Investing in physical gold and silver can provide diversification to your portfolio, as their value is often uncorrelated with other assets. Buying them through a self-directed IRA can allow your investment to grow on a tax-deferred or even tax-free basis. Additionally, a gold IRA can help you avoid portfolio management fees by allowing you to make your own purchases.

What are the benefits of buying gold and silver?

Gold and silver have historically provided a diversifying factor during periods of economic and geopolitical stress. In fact, during the 2008 financial crisis, gold and silver performed well while other assets fell. Gold prices rose 600% and silver went up 950% between 2001 and 2011. Gold and silver are often uncorrelated with other assets, which allows them to provide diversification. Moreover, physical metals have intrinsic value, and silver's value is enhanced because of its industrial uses. However, it's important to consult with your own legal, financial, and tax professionals before making any purchase.

How much are gold IRA fees?

Although the minimum purchase/funding requirements can vary, the set-up costs, storage fees, and annual fees usually exceed $100. For example, Rosland Capital has a $50 one-time set-up fee and $100 storage fee (some users may pay $150 for storage).

Should you roll your 401(k) into a gold IRA?

If you're looking for an alternative to mutual funds and other funds in your retirement account, gold IRAs may be worth considering. However, you should familiarize yourself with the fees and investment risks before making a decision. It's also a good idea to consult with a financial advisor or precious metals IRA specialist.

What is the minimum investment for a gold IRA?

While the IRS does not require a minimum investment amount, many gold IRA companies have their own requirements. For instance, Augusta Precious Metals requires clients to invest at least $50,000 in gold and other metals. However, other companies have lower minimum investment amounts. If your existing retirement accounts have not accrued much value, you may want to look for a gold IRA company with a low minimum investment requirement.

Can I keep a gold IRA at home?

No, you cannot keep physical gold bullion at home when investing in a gold IRA. The IRS requires that gold IRA investors keep their gold with an IRS-approved custodian, such as a bank or credit union. Failing to comply with this rule may result in a 10% tax penalty, income taxes on the distribution, and potentially, a tax audit. However, some gold IRA providers can ship your gold directly to you and provide insurance during transit. Once you receive your gold, you can choose to store it wherever you prefer.

Clear Conclusions And Obvious Observations

Investing in a gold IRA remains a popular option for diversifying a retirement portfolio and reducing asset volatility. Our list of top gold IRA companies makes it easy to set up a gold IRA account, work with expert advisors, and choose from a variety of precious metal products such as coins and bullion.

To choose the best gold IRA company for your needs, we recommend comparing the benefits and drawbacks of each provider. Some factors to consider include fees, commissions, reputation, customer service, and product selection. Additionally, you can request a free booklet from each provider to get a better understanding of their services.

Keep in mind that all of the companies on our list offer similar services, so you can't go wrong choosing any of them to manage your gold IRA investment. Whether you're a seasoned investor or just starting, investing in a gold IRA can provide a more stable retirement fund.

It's worth noting that the information in our list may have changed since its publication, so it's always a good idea to conduct your own research and stay up-to-date on the latest developments in the gold IRA market.