In an era defined by record inflation, geopolitical uncertainty, and a national debt soaring past $36 trillion, many conservative Americans are urgently seeking robust ways to protect their retirement savings. As traditional 401(k)s and IRAs face unprecedented challenges, the appeal of precious metals IRAs, particularly gold and silver, has surged. But with numerous providers available, how do you choose a trustworthy partner? This in-depth Noble Gold Investments Reviews guide delves into one of America's leading gold IRA companies. We'll explore Noble Gold's offerings—including gold & silver coins, bars, secure IRA accounts, and unique “Royal Survival Packs”—its distinguished reputation, transparent fee structure, and the seamless process for a 401(k) to gold IRA rollover. Read on to discover if Noble Gold Investments is the ideal solution to fortify your financial legacy with physical precious metals.

Noble Gold Investments – A Brief Overview

Quick Facts about Noble Gold Investments

Noble Gold Investments (noblegoldinvestments.com) is a private company that trades precious metals and offers individual retirement accounts (IRAs). CEO Collin Plume started the company in 2016. It is located in Pasadena, California. Noble Gold has quickly gained respect in the gold IRA industry. Plume has nearly 20 years of experience in finance and insurance. He started Noble Gold to teach Americans about alternative assets and help them protect their wealth. Plume values education over pushing sales. This is key to their approach. Their experience and articles in Forbes, Fox Business, and NPR show they are trustworthy experts. Noble Gold is favored by conservative pre-retirees and veterans. They offer affordable investments with a low minimum of $20,000 (sometimes advertised as low as $5,000).

| Established Year | 2016 | Main Office Location | Pasadena, California |

| Contact Number | (877) 646-5347 | Official Website | noblegoldinvestments.com |

| Customer Satisfaction Score | BBB: A+, Trustpilot: 4.7, Google: ~4.9 | Yearly Service Costs | Variable (Flat fees: ~$230/year for IRA) |

| 401(k) Rollover Support | Yes | Roth IRA Compatibility | Yes |

| Available Precious Metals | Gold, Silver, Palladium, Platinum | Trusted Custodial Partner | New Direction IRA |

| Special Offer | Free Gold & Silver IRA Guide | Global Storage Availability | Yes (Canada option available) |

| Home Storage Option | No (for IRAs), Yes (for direct purchases) | Dedicated Storage Service | Yes (Segregated storage) |

| Primary Storage Facility | Dallas, Texas (IDS) / New Castle, Delaware | Secure Vault Provider | International Depository Services (IDS) |

| Minimum Investment | $20,000 (IRA), sometimes advertised as low as $5,000 | Unique Feature | Royal Survival Packs, Exclusive Texas Depository |

Celebrity Endorsements and Trust Signals

Noble Gold CEO and Founder Collin Plume

Collin Plume has created and looked after wealth for his clients, advising on strategy and asset management. With over fifteen years of experience in property insurance, commercial real estate, and precious metals investments, he is well-versed in finance and economics.

He helped investors guard their wealth during the last recession, aligning clients’ interests in retail shopping centers across the American heartland to avert financial ruin. After extensive research, he joined a precious metals firm, quickly becoming one of the top brokers in the U.S. with over $28 million in sales in one year.

A recognized thought leader in the gold and crypto IRA industries, Collin boasts 19,600 LinkedIn followers. He frequently appears in interviews and provides opinion pieces for financial news outlets, such as an Investing News video discussing 2021 silver prices. Collin resides in the San Fernando Valley with his wife.

Co-founder of Noble Gold (2016) & CEO of Legacy Precious Metals Investments

Charles Thorngren, a prominent figure in the precious metals industry and finance in general, co-founded Noble Gold in 2016 with Colin Plume, quickly establishing a strong online presence as a leading expert and leader.

With over two decades of professional investment experience, Charles has particular expertise in precious metals. In November 2020, Charles left Noble Gold to become CEO of Legacy Precious Metals Investments, where he continues to drive innovation and growth in the niche. He is widely recognized as a thought leader in his field, frequently sharing his insights in dozens of published articles on precious metals economics and investment strategies. His work has appeared on prominent platforms (Apple Podcasts, Buzzsprout, and more), including the Noble Gold blog, and various financial news outlets, where he consistently offers valuable insights on market trends and capital protection. Charles's extensive knowledge and leadership continue to shape the precious metals investing landscape.

Kevin Sorbo: A Trusted Voice Endorsing Noble Gold

You might recognize Kevin Sorbo from his iconic roles as Hercules in “Hercules: The Legendary Journeys” or Captain Dylan Hunt in “Andromeda.” Beyond his successful career as an actor and director, Kevin Sorbo is a respected public figure known for his conservative views.

He lends his voice and endorsement to Noble Gold, appearing in their promotional materials and publicly supporting the company. His affiliation helps to assure potential investors, especially those who trust his public persona, that Noble Gold is a reputable choice for precious metals investments.

Pros and Cons of Noble Gold Investments Review

PROS

✅Low Minimum Investment: $5,000 for IRA, $2,000 for direct purchase (lower than many competitors)

✅Outstanding Customer Service: A+ BBB rating, 4.7-4.9 stars across review platforms, zero major complaints

✅Transparent Flat Fee Structure: $80 setup, $80/year custodian, $150-225/year storage (no percentage-based fees)

✅Unique Royal Survival Packs: Emergency preparedness metals with direct home delivery option

✅Exclusive Texas Storage: IDS Dallas vault option for enhanced privacy and security

✅IRS-Approved Segregated Storage: Fully insured by Lloyd's of London with clear ownership

✅Strong Educational Resources: Free Gold IRA Guide, comprehensive online materials, no-pressure sales approach

✅Comprehensive Buyback Program: No liquidation fees, competitive market rates

✅Complete Metal Selection: Gold, silver, platinum, palladium coins and bars for IRAs

✅Veteran-Owned Business: Conservative values that resonate with target demographic

✅Fast Account Setup: Streamlined process compared to larger competitors

CONS

⭕Limited Public Pricing: Requires phone calls for quotes (though common in the industry)

⭕Relatively New Company: Founded in 2016, less established track record than older firms

⭕Smaller Market Presence: Less brand recognition compared to industry giants

⭕Limited Physical Locations: Primarily online/phone-based service model

⭕Platinum/Palladium Less Prominent: Focus primarily on gold/silver, other metals require specific requests

⭕Higher Storage Fees: Annual storage costs can exceed some competitors for larger accounts

⭕Limited International Shipping: Primarily serves US-based customers

⭕No Guaranteed Buyback Pricing: Market-rate buybacks without price locks

Why Consider Gold & Silver IRAs Now?

- Historic Inflation and USD Decline:

- Under the Biden administration, inflation peaked at 9.1% in 2022 (highest since 1981), eroding the dollar's purchasing power.

- U.S. debt exceeded $36 trillion by late 2024, casting doubt on the long-term stability of the U.S. dollar.

- Gold and silver are seen as tangible assets that cannot be printed at will by the government, hedging against inflation and irresponsible fiscal policies.

- Proven Long-Term Performance:

- Since 1999, gold prices have skyrocketed by over 860%, while the S&P 500 index gained about 389%.

- An all-gold portfolio more than doubled the returns of an all-stock portfolio in the 21st century so far.

- Silver has risen roughly 400%+ since 2000, outpacing inflation.

- Safe Haven in Turbulent Times:

- Gold and silver provide stability and security during crises, often increasing in value when paper assets falter (e.g., during the 2001 dot-com crash and 2008 financial crisis).

- They are tangible assets that can be kept outside the banking system, offering an emergency payment method during events like bank shutdowns.

- Control, Privacy & Legacy:

- Physical precious metals offer a level of control and privacy that digital assets cannot, free from third-party risk.

- They can be passed to heirs privately and tax-efficiently, with no automatic reporting to authorities.

- Precious metals represent financial freedom: protection from inflation, insulation from political uncertainty, and direct control over wealth.

Company Overview and History

About the Noble Gold Team and History

Noble Gold Investments is a private precious metals dealer and IRA provider based in Pasadena, California, founded in 2016 by CEO Collin Plume. In just a few years, Noble Gold has grown into one of the most respected names in the gold IRA industry, frequently appearing alongside Augusta Precious Metals, Birch Gold Group, GoldenCrest Metals, and others in lists of the best Gold IRA companies.

Collin Plume started the firm after nearly two decades in finance and insurance, where he saw a need to educate Americans about alternative assets. He “realized how many people…lack knowledge or exposure about alternate investments such as precious metals,” and founded Noble Gold to help regular folks protect their assets and build generational wealth.

That philosophy of education over sales remains a core pillar of Noble Gold’s approach. Plume (who has 17+ years experience in wealth management) is a familiar voice in financial media – he’s been quoted on gold and the economy in Forbes, Fox Business, and even NPR. This credibility and thought leadership lend Noble Gold a strong reputation as knowledgeable, honest guides in the precious metals space.

Noble Gold Investments Reviews and Complaints

Client Testimonials and Praises

Absence of Major Complaints

In 2025, Noble Gold Investments continues to stand out as one of the few gold IRA account providers with a virtually flawless reputation on consumer review platforms. Despite operating in a sector often criticized for aggressive sales tactics and less-than-transparent pricing, Noble Gold maintains:

- Zero major complaints on authoritative review aggregators and legal databases

- A+ rating from the Better Business Bureau, with consistently positive feedback and no unresolved disputes

- Trustpilot score of 4.7/5, based on verified client reviews praising transparency, professionalism, and educational support

- Google and Consumer Affairs ratings averaging ~4.9/5, reinforcing their reputation for ethical service and client satisfaction

Independent audits and trust indices show that Noble Gold has very loyal customers, stable operations, and positive public feedback. The company encourages potential clients to read reviews, ask questions, and take their time before deciding. This proactive approach helps them avoid common industry mistakes.

In short, Noble Gold’s clean track record isn’t just a marketing claim—it’s a documented reality. For investors seeking a conservative, transparent, and client-first partner in precious metals, Noble Gold remains one of the safest bets in the space.

Company Values and Niche Focus

Noble Gold Investments clearly understands its target audience. The company has positioned itself toward Americans who prioritize patriotism, faith, and financial independence—values deeply rooted in the firm’s founding philosophy and team culture. Noble Gold frequently advertises on conservative media platforms and has historically earned endorsements from prominent right-leaning voices.

One notable example was commentator Charlie Kirk, who previously partnered with Noble Gold and publicly endorsed their services. The company was a long-time sponsor of The Charlie Kirk Show, and Kirk often praised Noble Gold as a trustworthy option for protecting wealth through precious metals. (Charlie Kirk was tragically assassinated in September 2025 during a public event in Utah. His earlier support remains a meaningful part of Noble Gold’s brand legacy.)

Noble Gold’s messaging often emphasizes safeguarding the American way of life and taking personal responsibility for one’s financial future—themes that resonate strongly with Republican and Christian investors. Importantly, the company also caters to small and mid-sized investors. While some gold IRA providers require $50,000+ minimums, Noble Gold offers entry points as low as $5,000 for IRAs and ~$2,000 for direct cash purchases, making it accessible to those with modest retirement accounts or new to precious metals.

In short, Noble Gold blends the customer-first ethos of a family-run firm with the infrastructure and expertise of a national dealer—tailored for conservative pre-retirees seeking safety, privacy, and legacy preservation.

Noble Gold’s Products & Services

One thing that sets Noble Gold apart is the breadth of precious metal products and services they offer. Whether you want to hold metals inside a tax-advantaged IRA or buy gold and silver for direct possession, Noble Gold has a solution. Below we break down their key offerings – from gold IRAs and silver IRAs to an array of coins, bars, and even unique “survival packs.”

Precious Metals IRAs (Gold IRA & Silver IRA)

Noble Gold’s flagship service is helping clients set up self-directed IRAs backed by physical precious metals. A Gold IRA account allows you to invest in physical gold (and other precious metals) within a special retirement account, enjoying the same tax benefits as a traditional IRA.

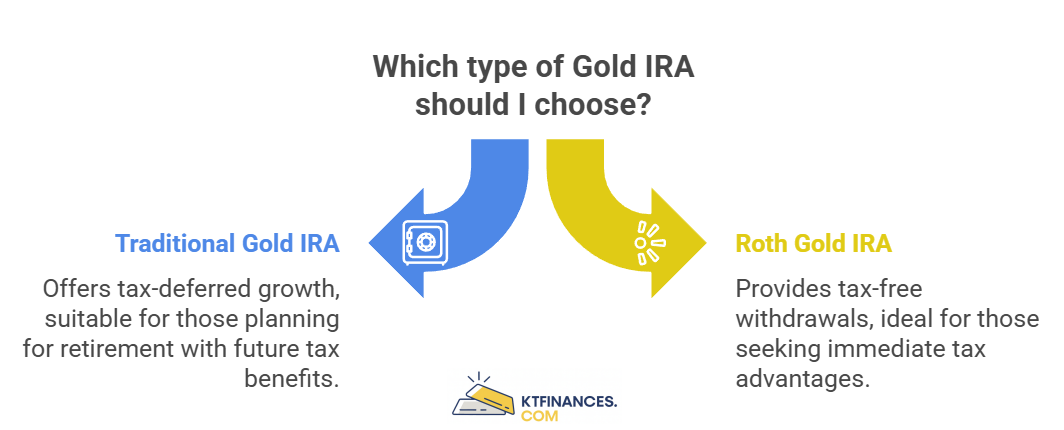

You can open a Traditional Gold IRA or a Roth Gold IRA, depending on whether you prefer tax-deferred growth or tax-free withdrawals – Noble Gold supports both types. They also accommodate rollovers or transfers from all sorts of accounts: 401(k)s, 403(b)s, Thrift Savings Plans (TSPs for federal employees), 457 plans, SEP IRAs, SIMPLE IRAs, and standard IRAs can all be moved into a precious metals IRA without penalty. If you have an old 401K from a previous job, Noble Gold’s team will guide you through a 401(k) to Gold IRA rollover, handling the paperwork to ensure the transfer is IRS-compliant and seamless.

Why a Gold or Silver IRA?

It lets you diversify your retirement portfolio beyond stocks and bonds. Gold often moves opposite to the stock market – when paper assets fall, gold tends to rise . This inverse correlation can hedge against market crashes. Noble Gold points out that gold has an “added security through diversification” that even billionaires and central banks rely on.

With a self-directed IRA from Noble, you can hold a range of precious metals: gold, silver, platinum, or palladium coins and bars that meet IRS purity standards (more on those below). Silver IRAs are an option for those bullish on silver’s industrial potential or who want more metal per dollar (since silver is cheaper per ounce). You can mix metals in one account as well – e.g. 50% gold, 50% silver.

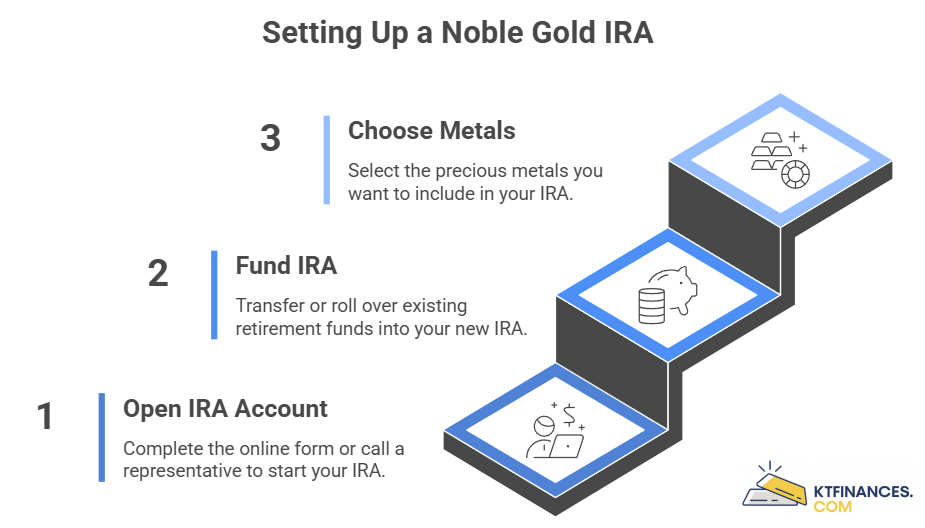

Setting Up an IRA with Noble Gold: The Process

Noble Gold makes the IRA setup process easy and quick. There is an online “Get Started” form to open a new self-directed IRA (or you can do it via phone with a representative). According to Noble Gold, it’s just 3 simple steps:

- Open the new IRA account;

- Fund it by transferring or rolling over existing retirement funds;

- And then choose your metals to purchase for the IRA.

Their team assists at each step, coordinating with your new IRA custodian and your current 401k/IRA provider so that the rollover is done correctly (usually tax-free with no early withdrawal penalties, since it’s a direct custodian-to custodian transfer in most cases).

IRS Rules and Eligibility

Precious metals IRAs are allowed by law (since 1997), but the IRS sets strict rules on what kind of metals can be included. Not all gold and silver products are IRA-eligible – they must meet minimum fineness standards and certain coins are excluded. Noble Gold deals exclusively in IRA approved bullion and coins when handling IRAs. The IRS requires gold to be at least 99.5% pure (except for the American Gold Eagle coin, which is 91.67% pure but explicitly allowed) and silver must be 99.9% pure. All the coins and bars offered by Noble Gold’s IRA department meet these standards.

Additionally, IRA metals must be held in a third-party depository (you cannot store them at home while in the IRA). Noble Gold will arrange secure storage for you through trusted depository partners (see “Storage & Security” below). When you eventually take distributions from your metals IRA (e.g. at retirement), you can choose to have the physical metals shipped to you, or have Noble Gold buy them back and provide cash.

Overall, a Gold or Silver IRA with Noble Gold lets you save for retirement in real, hard assets – a strategy that appeals to those worried about the stock market or dollar’s future.

Competitive Pricing and Price Match Policy

Noble Gold aims to offer competitive prices on their coins and bars. They leverage relationships with numerous mints and wholesalers (built over years) to get good dealer rates , and promise to beat or match market prices. They do not publish prices on the website (due to fluctuating spot prices), but you can easily call for a quote.

There’s also a no-quibble buyback program: if you ever want to sell your metals, Noble Gold will buy them back at fair market value with no liquidation fees. This guarantee can give peace of mind that you’ll have liquidity when needed (Of course, you’re free to shop around or sell to any dealer – the metals you purchase are common products with global markets.)

Gold and Silver Coins for IRA or Direct Purchase

Noble Gold offers an impressive catalog of precious metal coins – ranging from IRA-eligible bullion coins to rare historic coins for collectors. Below is a table of some of the popular gold coins available through Noble Gold (many of these can be held in an IRA, while others are available for direct purchase as a collectible or investment).

Gold Products

Popular Gold Coins Offered by Noble Gold (IRA-eligible unless noted).

Popular Gold Coins

| Gold Coin | Purity | Description & Notable Features |

|---|---|---|

| American Gold Eagle (Bullion) | 91.67% (22 karat) | Official U.S. gold bullion coin (1 oz, 1/2 oz, 1/4 oz, 1/10 oz sizes). First issued 1986, contains alloy of silver & copper for durability. IRS-approved (Congressional exception for 22k Eagles). Face value ($50 for 1 oz) is symbolic; true value tracks gold price. |

| American Gold Eagle – Proof | 91.67% (22 karat) | Collector's proof version of the Gold Eagle (1 oz, 1/2 oz, 1/4 oz, 1/10 oz). Specially struck by the U.S. Mint with polished dies for a mirror finish. Often sold in a display case. Can be held in IRAs (proof Eagles are IRA-eligible). |

| Canadian Gold Maple Leaf | 99.99% (24 karat) | Canada's official gold coin (1 oz, 1/2 oz, 1/4 oz sizes commonly). Renowned for its .9999 high purity and beautiful maple leaf design. Introduced in 1979; some editions are 99.999% pure. Legal tender in Canada. IRA-eligible. |

| Australian Gold Kangaroo/Nugget | 99.99% (24 karat) | Popular bullion from Perth Mint (1 oz, 1/2 oz, 1/4 oz, 1/10 oz). Design features a kangaroo (changes yearly). High purity and limited annual mintage add collectibility. IRA-eligible. |

| Austrian Gold Philharmonic | 99.99% (24 karat) | Austria's famed gold coin (1 oz, 1/2 oz, 1/4 oz, 1/10 oz). Debuted 1989 celebrating the Vienna Philharmonic Orchestra. Displays musical instruments on the design. IRA-eligible. |

| South African Gold Krugerrand | 91.67% (22 karat) | The original modern bullion coin (first issued 1967). Contains 1 oz gold with copper alloy; iconic Paul Kruger bust on obverse. Not IRA-eligible (only .9167 fine and not a US coin), but available for cash purchase. Still popular globally among investors. |

| Gold American Buffalo | 99.99% (24 karat) | U.S. Mint's 24k pure gold bullion coin (1 oz) featuring the Native American and buffalo design (from the old nickel). First issued 2006. IRA-eligible (purity .9999). |

| 1854 Kellogg $20 Coin (Rare) | ~90% (21.6k) | A pre-1933 U.S. gold coin struck privately during the California Gold Rush. Historic and collectible (not bullion). Not IRA eligible but Noble Gold offers such rare coins to collectors. |

IRA-Eligible Gold Coins

As shown, Noble Gold can provide all the top bullion coins one would want for a gold IRA – from American Eagles and Buffalos to Maples, Philharmonics, and Kangaroos. These coins offer the pure gold content required for IRAs while also being highly liquid and recognizable globally. Noble Gold’s Gold & Silver Investment Guide notes that they “offer only the finest quality bullion coin editions” that meet all IRS requirements.

Silver Products

For silver, Noble Gold’s lineup is equally robust. Here are some popular silver coins you can purchase (for an IRA or personal holding).

Popular Silver Coins

| Silver Coin | Purity | Description & Notes |

|---|---|---|

| American Silver Eagle (Bullion) | 99.9% pure silver | The official U.S. silver bullion coin (1 oz). First released 1986, backed by the U.S. Mint. Iconic Walking Liberty design. IRA-approved. Most popular silver IRA coin in the USA. |

| Canadian Silver Maple Leaf | 99.99% pure | Canada's $5 silver coin (1 oz). Introduced 1988, features Queen Elizabeth II and maple leaf. Very high purity and beautiful finish. IRA-eligible. |

| Austrian Silver Philharmonic | 99.9% pure | Austria's 1.5 Euro silver coin (1 oz). Matching design to the gold Philharmonic (musical instruments). Popular in Europe. IRA eligible. |

| Australian Silver Kangaroo | 99.9% pure | 1 oz silver coin from Perth Mint. Features the red kangaroo design; Queen Elizabeth II on obverse. IRA-eligible. |

| America the Beautiful 5 oz Silver | 99.9% pure | Large 5 oz silver coins issued by the U.S. Mint as part of the America the Beautiful quarters program. Beautiful detailed designs of national parks. IRA-eligible (5 oz is a bullion piece). |

| 1 Kilo Silver Coins (Perth Mint, etc) | 99.9% pure | E.g. the Australian Kookaburra or Koala 1 kilogram silver coins. These massive coins (32.15 oz) are popular for serious stackers. IRA-eligible as .999 fine. |

| 90% Silver U.S. Coins (“Junk Silver”) | 90% silver | Pre-1965 US dimes, quarters, half-dollars with silver content. Not IRA-eligible (below .999 purity), but Noble Gold may offer bags of junk silver for direct purchase as a hedge for currency collapse scenarios. |

IRA-Eligible Silver Coins

All silver coins listed above meet the IRS purity requirement of at least 99.9% (.999 fine) for inclusion in a precious metals IRA. From the iconic American Silver Eagle to the high-purity Canadian Maple Leaf and the artistic Austrian Philharmonic, these coins offer both liquidity and long-term security. Noble Gold ensures that each coin is sourced from trusted mints and qualifies for IRA storage, giving investors a tangible hedge against market volatility and digital risk.

Platinum and Palladium Products

Expand your precious metals portfolio beyond traditional gold and silver. Noble Gold offers opportunities to diversify into other valuable assets known for their industrial demand and investment potential.

Platinum and Palladium Coins/Bars

In addition to standard bullion, Noble Gold can also source platinum and palladium coins (like Platinum American Eagles, Canadian Platinum Maples, etc.) for those who want to diversify into other precious metals.

Rare and Collectible Coins

Rare Coins are another specialty – Noble Gold’s inventory has included certified rare coins such as historic U.S. $10 Liberty coins, $20 Saint-Gaudens Double Eagles, European gold coins, and more. These numismatic pieces aren’t for IRAs but can be attractive to collectors or investors who want potentially higher upside (and are okay with longer-term, illiquid assets). Noble Gold’s experts can guide buyers through the pros and cons of rare coins versus bullion.

Precious Metal Bars (Gold & Silver Bars)

For investors who prefer bars over coins (often to get a lower premium per ounce), Noble Gold provides IRA-approved bars in various sizes. All bars come from top-tier mints/refiners that meet IRS fineness requirements (99.5%+ for gold, 99.9%+ for silver). Here’s a look at some bars available:

Gold Bars

Noble Gold offers gold bars from renowned refiners like PAMP Suisse, Credit Suisse, Johnson Matthey, Engelhard, etc., in sizes ranging from small 5 gram bars up to 1 kilogram bars. Popular choices include the 1 oz and 10 oz gold bars. For example, the 1 oz PAMP Suisse Lady Fortuna gold bar (with the Lady Fortuna design) is a frequently selected option – it’s .9999 fine and comes sealed with an assay certificate.

Larger options like the 100 gram and 10 oz gold bars are available for those looking to make a significant gold investment at once . All these bars are IRA-eligible and known worldwide. Noble Gold’s guide highlights how these bars are “precisely measured ingots” produced by top mints, and they carry lower premiums than collectible coins.

Silver Bars

You can also buy silver bars through Noble Gold in sizes such as 1 oz, 10 oz, 1 kg, and 100 oz. Mints like Sunshine Mint, RCM (Royal Canadian Mint), and others supply these. A popular IRA silver bar is the 100 oz Royal Canadian Mint bar (0.9999 purity, with unique serial number).

For smaller increments, 10 oz silver bars from private mints are common. Silver bars typically have very low premium per ounce, letting you accumulate more metal for your dollar. They are fully IRA-approved as long as .999 fine.

Platinum & Palladium Bars

If interested, Noble Gold can also arrange platinum bars (often 1oz Credit Suisse or PAMP bars .9995+ fine) or palladium bars (usually 1 oz .9995 fine). These can be held in IRAs too.

One advantage Noble Gold offers is a broad selection – whether you want coins for recognizability or bars for maximum ounces, they can fulfill your order. And again, all IRA bars and coins offered meet the Internal Revenue Code’s standards, so you don’t have to worry about accidentally buying a non-allowed item for your IRA.

Royal Survival Packs

One of Noble Gold’s most interesting offerings (and a differentiator vs. other gold companies) is their “Royal Survival Packs.” These are essentially hand-picked portfolios of precious metals curated for emergency preparedness. The idea is to have a stash of portable, widely recognized metals that you could use for barter or quick access to wealth in a crisis scenario. This resonates with many in the prepper and veteran communities.

A Royal Survival Pack is not held in an IRA – it’s a direct purchase of physical metals that Noble Gold then ships securely to your door (fully insured). The metals arrive in a discreet, secure package to either your home or a secure location of your choice. Noble Gold offers several tiers of Survival Packs, typically named with regal or patriotic themes (e.g. Noble Cavalier, Knight, Ambassador, etc.), ranging from around $10,000 up to $500,000+ in value.

Each pack contains a mix of high-liquidity coins and bars. For example, a smaller pack might include a selection of 1 oz American Eagle gold coins, some fractional gold, and a lot of 1 oz Silver Eagle coins – pieces that in a disaster would be easily tradeable for goods or services. Larger packs might include more gold bars or higher value coins.

These Survival Packs are designed to give clients peace of mind that they have “financial insurance” if the banking system falters or in any SHTF scenario. As Noble Gold describes, the packs are for “clients interested in emergency preparedness” and contain “a selection of precious metals that can be shipped directly to the client.”

Once delivered, you can store your cache in a personal safe, secure vault, or bury it in the backyard – whatever your plan may be. Noble Gold’s team can advise on storage best practices as well (they note that sleeping with gold under your pillow is “no longer your only option,” given modern safes and concealment methods ).

Importantly, Noble Gold’s survival pack service is turn-key and confidential. They handle the procurement of all metals in the pack, quality-check them, and then arrange fully insured, discreet shipping. Clients have praised the convenience of getting a diversified stash in one go, rather than trying to source many different coins themselves.

This offering shows Noble Gold’s understanding of its clientele – many retirees not only want to invest, but also to prepare for uncertain futures. Having some physical gold and silver on hand provides a sense of security that goes beyond numbers on a brokerage statement.

Noble Gold Buyback Program

Understanding the importance of a complete investment cycle, Noble Gold proudly presents its comprehensive buyback program. This service is designed to give clients maximum confidence and flexibility in their precious metals investments, ensuring that when the time comes to sell, the process is as seamless and advantageous as the initial purchase. It's a testament to Noble Gold's commitment to long-term client support and the inherent liquidity of physical assets.

No-Hassle Buyback Guarantee

Noble Gold offers a distinctive “no-hassle” buyback guarantee for all precious metals purchased through them. This commitment provides clients with peace of mind, knowing that they always have a reliable avenue to sell their assets back to the company. There's no need to search for a third-party buyer or navigate complex market conditions when it's time to liquidate your holdings.

Liquidity and Exit Strategy

The buyback program serves as a crucial component of your investment's liquidity. It ensures that your precious metals are not just a static asset but one with a clear and straightforward exit strategy. Whether market conditions change or personal circumstances require cash, Noble Gold's buyback option facilitates a quick and efficient conversion of your physical gold, silver, platinum, or palladium back into currency, providing ultimate flexibility and control over your wealth.

Storage Facilities and Security

Whether you buy metals for an IRA or for direct delivery, Noble Gold places a strong emphasis on security and safety. Here’s how they handle storage and shipping.

IRS-Approved Depositories

For metals held inside an IRA, the law requires using an approved non bank trustee/depository to store the assets. Noble Gold has partnered with the highly regarded International Depository Services (IDS) group for vaulting. IDS offers ultra-secure storage facilities in multiple locations. Noble Gold gives clients a choice of three depository locations: Dallas, Texas, New Castle, Delaware, or Mississauga (Toronto), Canada for those who want an offshore storage option.

All three are cutting-edge vault facilities with top-tier security protocols, 24/7 monitoring, and comprehensive insurance coverage.

In fact, Noble Gold secured exclusive rights to the brand-new Dallas depository – they’re the only gold IRA company that can offer storage in that particular Texas vault. Many conservative investors love the idea of Texas storage (away from D.C. and Wall Street). Noble Gold proudly touts their “Texas only” depository option for clients who want a more local (and arguably more private) storage solution, rather than East Coast depositories.

Insurance and Segregation

All metals stored through Noble Gold are fully insured by Lloyd’s of London – the global leader in specialty insurance . This means your holdings are covered against theft, damage, or loss while in storage. Additionally, Noble Gold uses segregated storage by default for IRAs, not commingled or pooled storage.

Segregated storage means your coins and bars are kept in a dedicated space with your name on them; they are not mixed with other customers’ metals. You get back exactly the same items you put in. (Some competitors use “commingled” storage to cut costs, where clients share holdings – Noble Gold doesn’t do that.) The IDS depositories are COMEX, CME, LBMA, and ICE approved , meeting the highest industry standards. At Noble Gold’s preferred Texas facility, all assets are maintained in customer-specific custody accounts on a fully allocated basis.

Storage Fees:

Storing precious metals isn’t free, but Noble Gold’s fees are among the lowest in the industry. There is no fee to setup a storage account, just an annual fee. As of this writing, Noble Gold’s Gold IRA storage fee is $150/year (or $225/year for silver IRAs, which require more space by volume). If you choose the Texas depository, the fee is around $150 – and Noble Gold even gives a slight discount for Texas storage to encourage use of their partner facility.

This annual fee is the same flat amount regardless of how much metal you store (whether $10,000 or $1,000,000 worth). Custodian fees (for the IRA administration) are separate but also low – Noble Gold uses New Direction IRA as their primary custodian, which charges about $80/year for account maintenance . So all-in, an IRA investor might pay roughly $230/year total for custody and storage, which is very reasonable for the peace of mind and insurance provided.

Shipping Practices for Direct Purchases

For direct purchases (non-IRA metals that are shipped to you), Noble Gold has a stellar shipping operation. They promise fast and efficient delivery. All packages are sent fully insured and require a signature. The packaging is discrete – there is no indication of contents or flashy labeling that might attract thieves.

Noble Gold has relationships with various mints and suppliers, which allows them to source metals quickly and in stock , even during times of high demand. Most orders are processed and shipped within a few days. Clients often report receiving their metals within 5-7 business days of funds clearing, although times can vary.

Proof of Purchase (POP) Transparency

Additionally, Noble Gold offers a unique service called “POP – Proof of Purchase”: when your metals are being delivered to the depository for your IRA, Noble Gold provides photographs of your actual coins/bars arriving and being stored. This is an extra layer of transparency so you can see that the metals you bought are real and safely deposited.

POP is provided free to all Noble Gold IRA clients and helps give peace of mind, especially for first-time gold buyers.

Finally, Noble Gold’s team stands by to support any future needs – whether that’s re-selling your metals through their buyback program, facilitating a withdrawal or home delivery from your IRA, or even moving your metals to a different depository if desired. They act as a partner for the long haul, not just a one-time dealer.

Noble Gold IRA Fees and Minimums

How much does it cost to invest with Noble Gold? The good news is that Noble Gold has transparent and low fees, with some of the lowest minimum investment requirements in the sector.

Account Setup and Custodian Fees

Account Setup Fee: $80 (one-time) for new IRA accounts. This covers creating your self directed IRA paperwork with the custodian. Some competitors charge $100 or more, so this is relatively low. Occasionally Noble Gold runs promotions waiving setup fees, so ask about that.

Annual Custodian Fee: $80 per year (paid to the IRA custodian, New Direction IRA). This is standard for maintaining the IRA paperwork, facilitating transactions, and IRS reporting.

Annual Storage Fees

Annual Storage Fee: $150 per year for gold (or platinum/palladium) IRAs; $225 per year for silver IRAs (silver requires more vault space by volume) . If you use Texas or Delaware storage, the fee may be $150; for international (Toronto) it can be a bit higher (around $225). Noble Gold charges one flat fee regardless of account size, which is great for larger investors especially. By comparison, some firms charge a percentage of asset value which can get very expensive as your holdings grow.

Shipping & Insurance Fees: For direct purchases, Noble Gold often provides free insured shipping on orders over $5,000 (which is most orders). Below that, a small shipping fee may apply (often around $30-$50) depending on weight and destination. They will clarify before finalizing the order.

Commission/Spread on Metals

Noble Gold, like all dealers, makes a small gross profit on the difference between wholesale and retail prices of metals (the “spread”). They do not charge a separate commission on top of the metal price. Typically, common bullion products might be priced at 2-5% above the melt value for gold, and maybe 5-10% above for silver (which reflects the market premium).

Rare coins have higher markups. Noble Gold’s prices are competitive; they don’t gouge customers with excessive premiums. They also have a price match policy if you find a significantly better quote elsewhere.

Minimum Investment Requirements

Noble Gold’s minimum to open an IRA is $5,000 (or $2,000 for a cash purchase of metals outside an IRA). This is very accessible – for context, Augusta and some others require $50k minimum IRA, and even GoldenCrest Metals is usually $10k. Noble Gold’s low entry point is one reason it’s often recommended for “beginners” or smaller investors. That said, many clients invest much more; Noble Gold has many high-net-worth customers too.

The $5k minimum means even if you only have a small IRA or a portion of your 401k to roll over, you can still get started with precious metals investing.

No Hidden Fees Policy

There are no management fees, no performance fees, no selling fees. The only ongoing costs are the flat torage/custodian fees above. If you eventually decide to take delivery of your metals from the IRA, there may be a shipping fee to send them to you at that time. If you sell metals back to Noble Gold, they do not charge a liquidation fee – they will likely earn a small spread on the repurchase, but no extra penalty or fee to you.

Overall, Noble Gold’s fee structure is straightforward and budget-friendly for retirees. For roughly a few hundred dollars a year, you can maintain a precious metals IRA – a worthwhile insurance cost for the protection it provides your portfolio. And for direct buyers, the free shipping on larger orders and competitive pricing make dealing with Noble Gold cost-effective.

Educational Resources and Support

At Noble Gold, empowering investors with knowledge is a core principle. They believe that informed decisions lead to successful investments, offering a wealth of resources to guide clients through the complexities of precious metals and retirement planning.

Free Gold IRA Guide

If you’re new to precious metals or just want more information, Noble Gold offers a free investment kit with absolutely no obligation. It’s often advertised as the “Free Gold & Silver IRA Guide”. This comprehensive packet (digital or physical) includes Noble Gold’s detailed guides, market charts, and straightforward explanations of how gold IRAs work, the benefits and potential risks, and a comparison of options. It’s a great starting point to educate yourself further – and true to Noble’s mission, it focuses on education rather than a sales pitch.

You can Request Your FREE Gold IRA Guide Now by visiting Noble Gold’s website and filling out a short form (or call their number). They’ll send the guide and have a representative available to answer any questions you have. Many conservative investors have found this guide helpful in clarifying how to move from a traditional 401k or IRA into a precious metals IRA safely.

Online Article Library and Quizzes

Noble Gold’s website also features a library of articles and even quizzes on investing basics. They truly want clients to be well-informed. Taking advantage of these free resources can build your confidence in making the right decision for your retirement. These tools are designed to empower investors with knowledge, covering various aspects of precious metals investing and market trends.

Expert Advisory Services

Beyond self-guided resources, Noble Gold provides access to expert advisory services. Their team of specialists is available to guide buyers through the pros and cons of different investment options, from rare coins versus bullion to understanding the nuances of Gold IRAs. These experts ensure clients receive personalized support and informed recommendations, helping them make strategic decisions aligned with their financial goals.

Alternatives to Noble Gold Investments

While Noble Gold stands as a strong contender in the precious metals market, it's prudent for any savvy investor to consider all available options. Understanding the competitive landscape ensures you select the provider that best aligns with your financial goals and service expectations.

Comparison with Top Competitors

While Noble Gold offers compelling services, investors often consider various options before making a decision. Key competitors in the precious metals IRA space include firms like Augusta Precious Metals, GoldenCrest Metals, Birch Gold Group.

Each of these companies provides similar services for setting up precious metals IRAs, often with slightly different fee structures, product selections, or customer service approaches. Exploring these alternatives can help investors find the best fit for their individual needs and preferences.

FAQ – Frequently Asked Questions

Below we address some common questions about Noble Gold Investments and Gold IRAs, especially for those approaching retirement who want to protect their 401K or IRA with gold:

What is a Gold IRA and is it legal?

A Gold IRA is a self-directed retirement account holding physical gold (or other precious metals), offering the same tax benefits as a regular IRA. It's been legal since 1997, but metals must meet IRS purity standards (99.5% for gold, 99.9% for silver) and be stored in an insured, licensed depository. You cannot keep IRA gold at home. Noble Gold ensures all rules are followed, making it an IRS-approved, legitimate way to diversify your retirement savings against inflation and market volatility.

How do I roll over my 401(k) or IRA into a Gold IRA with Noble Gold?

The rollover is straightforward with Noble Gold's assistance. You open a new self-directed IRA through their custodian. Noble Gold then helps initiate a rollover/transfer from your existing retirement account (401k, IRA, etc.) directly into the new Gold IRA, ensuring it's a non-taxable event. Once funds arrive, you purchase IRA-eligible metals with Noble Gold's guidance, and they are sent to a secure depository. The entire process, including paperwork, is designed to be quick and painless.

What are Noble Gold’s fees and account minimums?

Noble Gold has low fees and minimums. For an IRA, there's a one-time $80 setup fee and an annual $80 maintenance fee (custodian). Storage costs $150/year (gold/platinum) or $225/year (silver) for fully insured, segregated vaulting. Their profit comes from a small spread on metals sold, with no commissions. The minimum investment is $5,000 for an IRA (or $2,000 for direct delivery), making it very accessible compared to competitors. Total annual fees for most IRAs are roughly $230/year.

Where are my metals stored and are they safe?

IRA metals are stored in approved, ultra-secure depositories like those in Dallas, Texas, Delaware (USA), or Toronto (Canada), run by professional companies (e.g., IDS). Your assets are fully insured by Lloyd’s of London and kept in segregated storage under your name. Noble Gold offers access to a new private depository in Dallas. For home delivery (non-IRA), metals are discreetly shipped, fully insured, and arrive quickly. Safety is a top priority, with authentic metals protected in transit and in vaults.

Does Noble Gold offer home delivery or can I keep the metals myself?

Yes, for direct purchases outside an IRA, you can choose home delivery and keep the metals yourself (e.g., Royal Survival Packs). However, for IRA assets, home storage is strictly not allowed by the IRS; metals must remain in an approved depository until distribution. Noble Gold facilitates both strategies: you can roll over part of your 401k into a Gold IRA for professional storage, and also purchase additional metals for personal physical possession. Their advisors can help you weigh the pros and cons for your goals.

Will Noble Gold buy back my metals when I’m ready to sell?

Yes, Noble Gold offers a “no-hassle” buyback program. They will purchase your metals at or very close to the current market rate, with no extra fees or penalties for selling back to them. This provides an easy exit strategy and ensures liquidity, especially for IRA holders taking distributions. While you're not obligated to sell to Noble Gold, their readiness to buy back reflects confidence in their products and provides a seamless process from purchase to eventual sale.

Conclusion

Noble Gold Investments has firmly established itself as one of the best gold IRA companies, earning a strong reputation as a trustworthy, client-focused firm that aligns well with conservative investment values. Their deep expertise in precious metals combined with a personal touch that prioritizes education makes them an excellent choice. In an era of inflation fears, volatile markets, and political uncertainty, Noble Gold offers retirees and pre-retirees a tangible way to secure their wealth – whether through a Gold & Silver IRA account or by buying gold and silver coins/bars for home storage.

With endorsements from respected voices, top-tier customer service, and products ranging from classic American Gold Eagles to unique Survival Packs, Noble Gold makes it easy to invest in gold on your terms. If you’re looking to protect your IRA or 401K by owning physical precious metals, Noble Gold is definitely a company to consider.

As always, I encourage you to do your due diligence, read customer reviews, and consult with Noble Gold’s advisors (be sure to grab their free Gold IRA guide!) to see how gold and silver could play a role in preserving your wealth and legacy for the generations to come.

If you're still comparing options and seeking the right company for your precious metals investments, I invite you to check out my article on the top precious metal investment companies in the U.S.. Many leading firms, such as Augusta Precious Metals and GoldenCrest Metals, also offer valuable resources, including free investment guides, to help you make an informed decision.